Price Movement

The price of MCX Crude closed at 5866 on June 9, 2023, down 1.15% from the previous week’s close of 5941 . The week was marked by volatility, with the price ranging from a high of 6138 to a low of 5760.

Key Drivers

The main drivers of the price movement in the past week were:

- Weaker demand: The demand for crude oil has been weak in recent weeks due to the slowdown in the global economy. This has led to a build-up of crude oil inventories, which has put downward pressure on prices.

- Rising interest rates: The US Federal Reserve has raised interest rates in an effort to combat inflation. This has made it more expensive for businesses to borrow money, which could lead to a slowdown in economic activity and a decline in demand for crude oil.

- Geopolitical tensions: The ongoing war in Ukraine has raised concerns about global energy security. This has supported prices, as investors have bought crude oil as a hedge against supply disruptions.

Outlook

The outlook for MCX Crude is uncertain. The weak demand and rising interest rates could weigh on prices in the near term. However, the geopolitical tensions could support prices. Overall, the market is likely to remain volatile in the coming weeks.

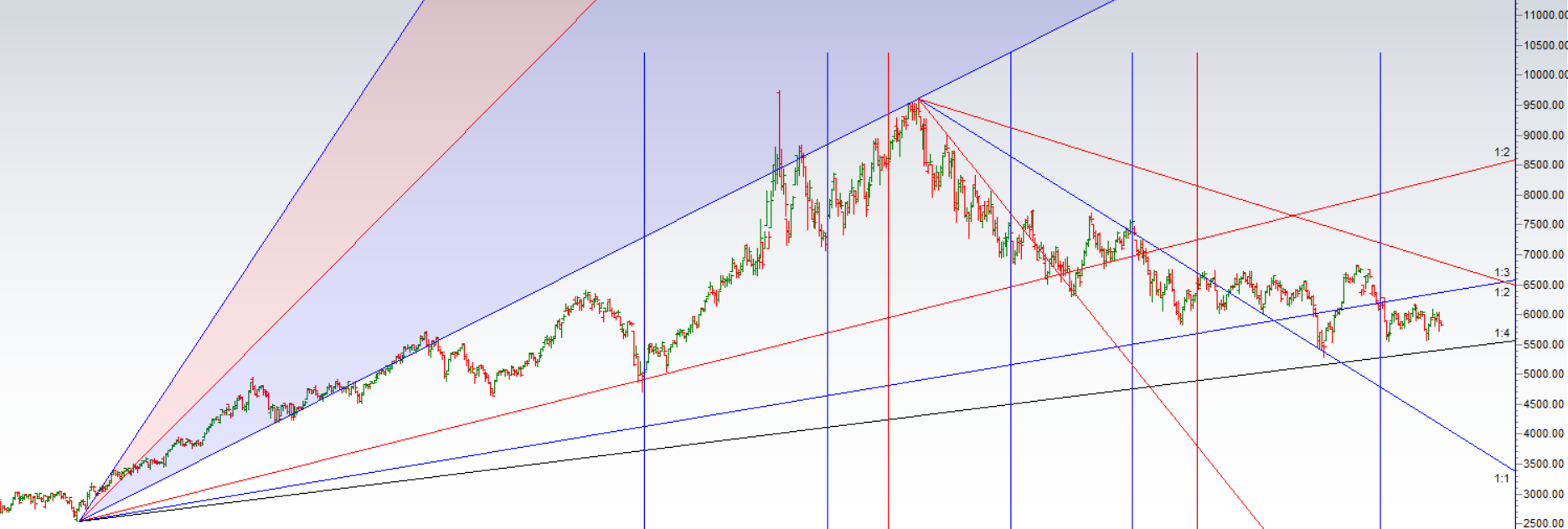

MCX Crude Oil Gann Angle Chart

Crude price showed strong revesal can lead to fall towards 5729/5610

MCX Crude Oil Astro Support and Resistace Line

Below 5900 Price can see fall towards 5825/5729 once mercury line of support is broken.

MCX Crude Oil Crude Harmonic

Crude can see move towards 5824/5729/5555 once below 5950