Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by SELLING 8278 contracts worth 745 crores, resulting in a decrease of 93188 contracts in the Net Open Interest. FIIs sold 45708 long contracts and covered 68693 short contracts, indicating a preference for closing exiting positions .With a Net FII Long Short ratio of 1.35 , FIIs utilized the market fall to exit Long positions and exit short positions in NIFTY Futures.

As Discussed in Last Analysis Nifty has formed gravestone DOJI after the DOJI formed yesterday and also closed below yesterday low suggesting weakness has started creeping in.

We have discussed the importance of Jupiter 18 Uranus and Mars Square Jupiter Aspect in below video, we can see a trending move tommrow.

Nifty saw a decline in morning but covered all in last hour of trade, Today we have North Node Aspect which leads to volatile move and weekly close also, Bulls would like to have close around 18385-18400 and bears below 18225-18200.

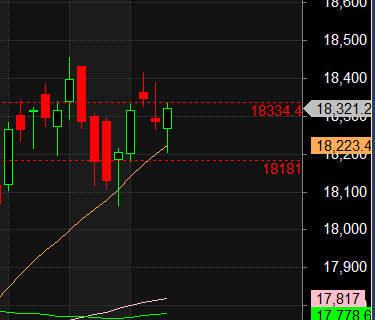

Price has closed above 20 SMA on Daily time frame with Hammer formation. For Swing Traders Bulls need to move above 18329 for a move towards 18396/18463 Bears will get active below 18262 for a move towards 18194/18127

Traders may watch out for potential intraday reversals at 9:15,10:11,12:46,1:12,2:16 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 0.83 lakh, witnessing a addition of 20.1 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Nifty Advance Decline Ratio at 28:22 and Nifty Rollover Cost is @18407 and Rollover is at 66.8%.

Nifty options chain shows that the maximum pain point is at 18300 and the put-call ratio (PCR) is at 1. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 18400 strike, followed by 18500 strikes. On the put side, the highest OI is at the 18200 strike, followed by 18100 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 18200-18400 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 589 crores, while Domestic Institutional Investors (DII) bought 338 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 17744-18272-18800 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price has close above 18272

One of the main reason why technical analysis works is that human nature and emotions remain the same irrespective of era one is in. People were greedy and fearful even a hundred years back as much as they are now.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 18439 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 18359 , Which Acts As An Intraday Trend Change Level.