Foreign Institutional Investors (FIIs) displayed a Neutral approach in the Index Futures market by Shorting 3052 contracts worth 292 crores, resulting in a decrease of 4054 contracts in the Net Open Interest. FIIs bought 501 long contracts and Sold 3553 short contracts, indicating a preference for initiating new Short positions. With a Net FII Long Short ratio of 0.56 , FIIs utilized the market fall to enter long positions and enter short positions in Index Futures.

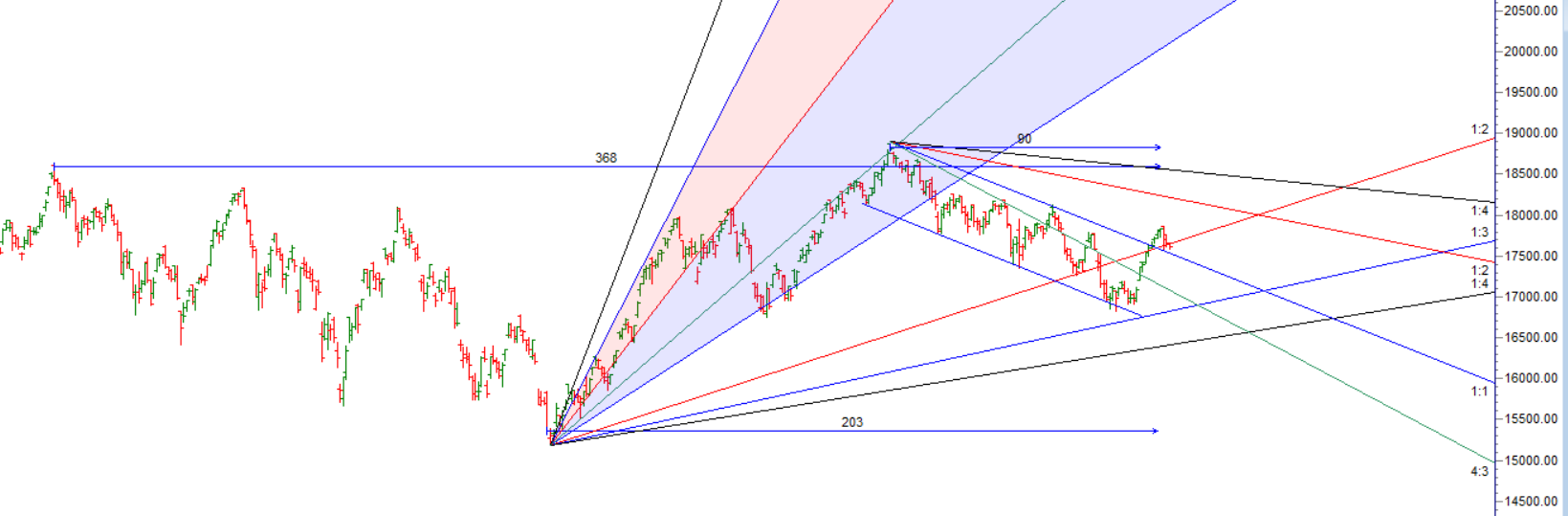

As Discussed in Last Analysis “Sun ingress” is a term used in astrology to refer to the movement of the Sun into a new zodiac sign. This is believed to have an impact on financial markets and can cause market volatility. Nifty has formed another O=H and price is taking multiple support at 1×2 gann angle any break of 17576 can lead to big fall. Today Mercury Declination is at its Extreme and Sun moving in Tarus and tommrow we will have Solar Eclipse so time to be extremly cautious. First 15 Mins High and Low can be used by Traders to trade for the day.

A hybrid solar eclipse occurs when the moon passes directly between the earth and the sun, but the size of the moon is not large enough to completely block out the sun. As a result, some parts of the earth will experience a total solar eclipse, while others will see an annular solar eclipse. Solar eclipses have been known to have a significant impact on the stock market. Studies have shown that the stock market tends to be volatile during the weeks leading up to and following a solar eclipse. In the past, some major stock market crashes have occurred within a year of a solar eclipse. Price is back to 1×2 angle suport and holding 17600. Last Hybrid SOlar Eclpise happened on 03 Nov 2013, Nifty topped out on 05 Nov and saw a decline.

The Narrow Range 7 (NR7) trade setup is a popular strategy used by traders to identify potential breakouts in the market. The NR7 pattern occurs when the range of the current trading day is smaller than the previous six trading days. This suggests that there is a decrease in volatility and that the market may be preparing for a significant move.

To execute an NR7 trade setup, traders will typically wait for a breakout above or below the narrow range of the seventh day. If the breakout is to the upside, traders will go long and if the breakout is to the downside, they will go short. Traders will often use stop-loss orders to minimize risk and exit the trade if the market moves against them.

For Swing Traders Break of 17576 can see a fall towards 17532/17453/17375/17297. Bulls will get active above 17700 for a move towards 17752/17795/17838.

Traders may watch out for potential intraday reversals at 9:15,9:53,11:01,12:42,1:33 How to Find and Trade Intraday Reversal Times

17817 is the 50% point, and 17826 is the musical octave point. It may be a good time to book profits in long positions and set a trailing stop loss at 17729. A fresh entry can be considered on a 15-minute close above 17850. For aggressive shorts, a stop loss can be placed at 17848 — Very Nice Pullback from 17817 towards 62.5 % point.

Nifty April Futures Open Interest Volume stood at 0.92 lakh, witnessing a addition of 1.2 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a closure of short positions today.

Nifty options chain shows that the maximum pain point is at 17650 and the put-call ratio (PCR) is at 0.98. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. This suggests that Nifty may trade within a range of 17600-17800 levels in the near term.

According To Recent Data, Retailers Have bought 676211 Call Option Contracts and Shorted 624600 CALL Option Contracts. Additionally, They bought 598514 Put Option Contracts And covered 519921 Shorted Put Option Contracts, Indicating A Bullish Outlook.

In Contrast, Foreign Institutional Investors (FIIs) bought 55433 Call Option Contracts And Shorted 45607 Call Option Contracts. On The Put Side, FIIs bought 44523 Put Option Contracts And Shorted 68349 Put Option Contracts, Suggesting They Have Turned To A Bearish Bias.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 17,700 strike, followed by 17,800 strikes. On the put side, the highest OI is at the 17600 strike, followed by 17500 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 17500-17700 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 13 crores, while Domestic Institutional Investors (DII) sold 401 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 16825-17326-17826. This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Trading discipline” comes from modifying one’s behaviour in a desired direction and overcoming the mental resistance and fear that generally get in the way.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 17617 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 17668 , Which Acts As An Intraday Trend Change Level.