As Discussed In Last Analysis “Sun ingress” is a term used in astrology to refer to the movement of the Sun into a new zodiac sign. This is believed to have an impact on financial markets and can cause market volatility. Bank Nifty price is taking multiple support at 4×3 gann angle any break of 42100 can lead to fall towards 41800-41600. Today Mercury Declination is at its Extreme and Sun moving in Tarus and tommrow we will have Solar Eclipse so time to be extremly cautious. First 15 Mins High and Low can be used by Traders to trade for the day.

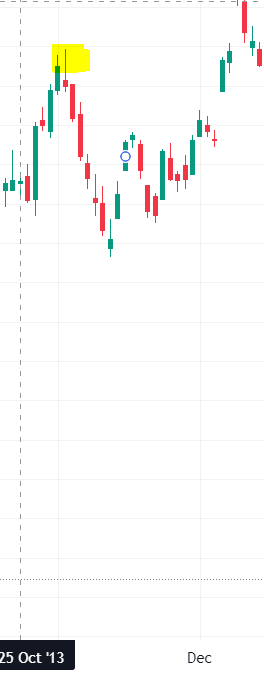

A hybrid solar eclipse occurs when the moon passes directly between the earth and the sun, but the size of the moon is not large enough to completely block out the sun. As a result, some parts of the earth will experience a total solar eclipse, while others will see an annular solar eclipse. Solar eclipses have been known to have a significant impact on the stock market. Studies have shown that the stock market tends to be volatile during the weeks leading up to and following a solar eclipse. In the past, some major stock market crashes have occurred within a year of a solar eclipse. Price is back to 4×4 angle suport and holding 42000. Last Hybrid SOlar Eclpise happened on 03 Nov 2013, Bank Nifty topped out on 05 Nov and saw a decline.

An inside bar is a price pattern that occurs when the price of an asset is confined within the high and low range of the previous candlestick. In other words, the inside bar has a smaller trading range than the previous bar. This pattern shows that the market is consolidating, and there is indecision among buyers and sellers. When an inside bar pattern is formed, it can signal that a potential breakout is imminent.By using this strategy, traders can enter the market at a low-risk point and maximize their profits. The entry signal occurs when the price of the asset breaks out of the high or low range of the inside bar. Traders should enter a long position if the price breaks out above the high of the inside bar, and enter a short position if the price breaks out below the low of the inside bar. This entry signal provides a low-risk entry point, as traders can place their stop-loss orders just below the low of the inside bar for a long position or just above the high of the inside bar for a short position.

For Swing Traders Break of 42108 can see a fall towards 41921/41728/41534/41341 . Bulls will get active above 42500 for a move towards 42693/42887/43080

Traders may watch out for potential intraday reversals at 9:15,9:53,11:01,12:42,1:33 How to Find and Trade Intraday Reversal Times

Bank Nifty April Futures Open Interest Volume stood at 23.09 lakh, addition of 0.62 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a addition of SHort positions today.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 40789-41967-43216 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 42500 strike, followed by the 43000 strike. On the put side, the 43000 strike has the highest OI, followed by the 41500 strike. This indicates that market participants anticipate Bank Nifty to stay within the 41800-41300 range.

The Bank Nifty options chain shows that the maximum pain point is at 42100 and the put-call ratio (PCR) is at 0.97 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Trading discipline” comes from modifying one’s behaviour in a desired direction and overcoming the mental resistance and fear that generally get in the way.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 41395 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 42206 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels:

Buy above 42200 with targets at 42323, 42422 and 42555 Bank Nifty Spot Levels)

Sell below 42000 with targets at 41888,41729 and 41610 (Bank Nifty Spot Levels)

Upper End of Expiry : 42422

Lower End of Expiry : 41885

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.