Are you Tradiing in Bank Nifty or considering it as a trading opportunity? The monthly expiry in March 2023 is an important event to watch out for, as it can affect the prices of Bank Nifty futures and options. In this post, we provide you with insights and analysis on what to expect from this expiry and how to prepare for it.

The inside bar pattern is a popular price action setup that can help traders identify potential trend reversals or continuations. In this post, we’ll focus on how to apply this pattern to the Bank Nifty index, which tracks the performance of the banking sector in India.

An inside bar occurs when the range of a candlestick is fully contained within the range of the previous candlestick. In other words, the high and low of the current candlestick are within the high and low of the previous candlestick. This indicates a contraction in volatility and a potential consolidation or indecision in the market.

Manage your risk and position size: Trading the Bank Nifty inside bar pattern involves some risks, such as false breakouts, slippage, or gap openings. To minimize these risks, you should use proper risk management techniques such as limiting your exposure to a certain percentage of your account, using a trailing stop loss, or scaling in and out of your positions.

Swing traders can expect a potential move towards 39905, 40116, or 40327 if the Bank Nifty trades above 39700. However, if the Bank Nifty falls below 39270 , Bears may become more active, leading to a move towards 39063,38852,38641,38430

Traders may watch out for potential intraday reversals at 9:23,10:31,11:36,1:20, 2:07,2:56. How to Find and Trade Intraday Reversal Times

Bank Nifty April Futures Open Interest Volume stood at 28.4 lakh, addition of 3.2 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a closure of Short positions and addition of longs today.

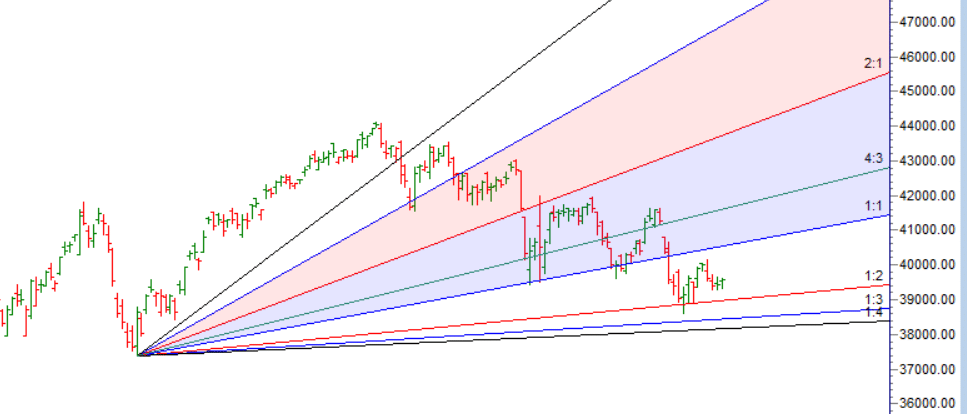

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 38227-39332-40502-41672. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels.

Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

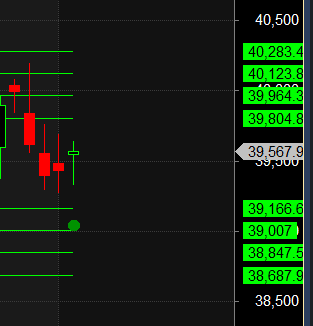

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 39800 strike, followed by the 40000 strike. On the put side, the 39500 strike has the highest OI, followed by the 39300 strike. This indicates that market participants anticipate Bank Nifty to stay within the39500-40000 range.

The Bank Nifty options chain shows that the maximum pain point is at 39600 and the put-call ratio (PCR) is at 1.01. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

I know it may sound strange to many readers, but there is an inverse relationship between analysis and trading results. More analysis or being able to make distinctions in the market’s behaviour will not produce better trading results– Mark Douglas

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 40196 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 39519 , Which Acts As An Intraday Trend Change Level.

Intraday Trading Levels:

Buy above 39600 with targets at 39700, 39832 and 40000 (Bank Nifty Spot Levels)

Sell below 39485 with targets at 39380, 39225 and 39061 (Bank Nifty Spot Levels)

Upper End of Expiry : 39900

Lower End of Expiry : 39275

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.