Foreign Institutional Investors (FII) showed a Neutral approach in the Index Futures market by buying 854 contracts worth 81.59 crores, resulting in a decrease of 8254 contracts in the Net Open Interest. FII’s sold 3700 long contracts and covered 4554 short contracts, indicating a preference for profit booking on exisiting positions. With a Net FII Long Short ratio of 0.13 ,lowest in many months FII used the market fall to exit long and exit short positions in Index Futures.

As Discussed In Last Analysis Nifty correction may be unsettling for traders as we have seen fall of 532 points in just 5 trading sessions. As traders, it’s important to stay calm during market corrections and not panic. Corrections can present great buying opportunities for those who have a long-term view of the market. It’s also important to have a solid trading plan in place and to stick to your strategy.

In the world of trading, there are certain Astro rules that traders follow to gain insights into market trends and potential reversals. Today, we’re highlighting two important Bayer rules that traders should keep in mind.

Bayer Rule 15 states that by analyzing the position of Venus relative to the Sun, traders can gain insights into major market moves and potential reversals. Specifically, traders should pay attention to Venus Heliocentric Latitude at extreme and least speeds, as these can indicate significant changes in market direction.

Rule No. 38 focuses on Mercury Latitude Heliocentric, which can also provide valuable insights for traders. When Mercury is in motion and passes certain degrees, it can produce powerful tops and bottoms in the market.

By understanding these rules and analyzing the movements of Venus and Mercury, traders can make more informed trading decisions and potentially profit from major market moves.

In conclusion, it’s important for traders to keep an eye on celestial movements and pay attention to these important Bayer rules. By doing so, they can gain a deeper understanding of market trends and potentially make profitable trades.

Credit Suisse, a major banking institution, has been in the news recently and its performance has had a negative impact on stocks around the world. However, there has been a recent update that the Swiss National Bank has stated it will provide Credit Suisse with liquidity if necessary, which could potentially boost sentiment in the short term.

As for the Nifty index, it is currently near the Gann Angle , and if it can hold above the low of 17900 for at least an hour, it may provide some relief for bullish traders. However, in order for a short-term bottom to be formed and a rally to occur, the Nifty needs to close above 17025 on a daily basis.

It is important to note that the selling based on advance tax has ended and the NAV (net asset value) game will begin, so traders should exercise caution.

Furthermore, two important astrological events are happening today: Mercury Conjunct Neptune and Mercury Square Mars. For intraday traders, the high and low of the first 15 minutes of trading will be important indicators to guide their trading decisions.

Swing traders can expect a potential move towards 17331, 17462, or 17555 if the market trades above 17233. However, if the market falls below 16978 , bears may become more active, leading to a move towards 16880,16750

Traders may watch out for potential intraday reversals at 9:31,11:16, 12:40, 1:12, 2:08 and 2:48. How to Find and Trade Intraday Reversal Times

Nifty March Futures Open Interest Volume stood at 1.23 lakh, witnessing a addition of 0.34 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of short positions today.

Nifty options chain shows that the maximum pain point is at 17100 and the put-call ratio (PCR) is at 1.05. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. This suggests that Nifty may trade within a range of 16900-17200 levels in the near term

According to recent data, retailers have bought 965660 call option contracts and shorted 848202 put option contracts. Additionally, they bought 331608 put option contracts and added 287999 shorted put option contracts, indicating a bullish outlook.

In contrast, foreign institutional investors (FIIs) sold 56443 call option contracts and shorted 2957 call option contracts. On the put side, FIIs sold 22599 put option contracts and shorted 44585 put option contracts, suggesting they have turned to a neutral bias.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 17,100 strike, followed by 17,200 strikes. On the put side, the highest OI is at the 16900 strike, followed by 16800 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 16900-17200 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 1271 crores, while Domestic Institutional Investors (DII) bought 1823 crores.

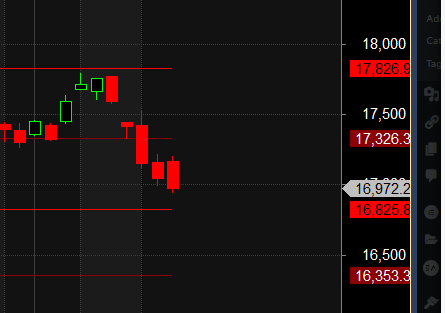

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 16825-17326-17826. This means that traders can take a position and potentially ride the move as Nifty moves through these levels.

Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

“To be a successful trader, you have to be able to admit mistakes. People who are very bright don’t make very many mistakes. They don’t make very much money.” – William O’Neil

For Positional Traders, The Nifty Futures’ Trend Change Level is At 17502 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 17151 , Which Acts As An Intraday Trend Change Level.