FII bought 10.3 K contract of Index Future worth 966 cores, Net OI has decreased by 10.9 K contract 316 Long contract were covered by FII and 10.6 K Shorts were covered by FII. Net FII Long Short ratio at 0.30 so FII used fall to exit Long and exit short in Index Futures.

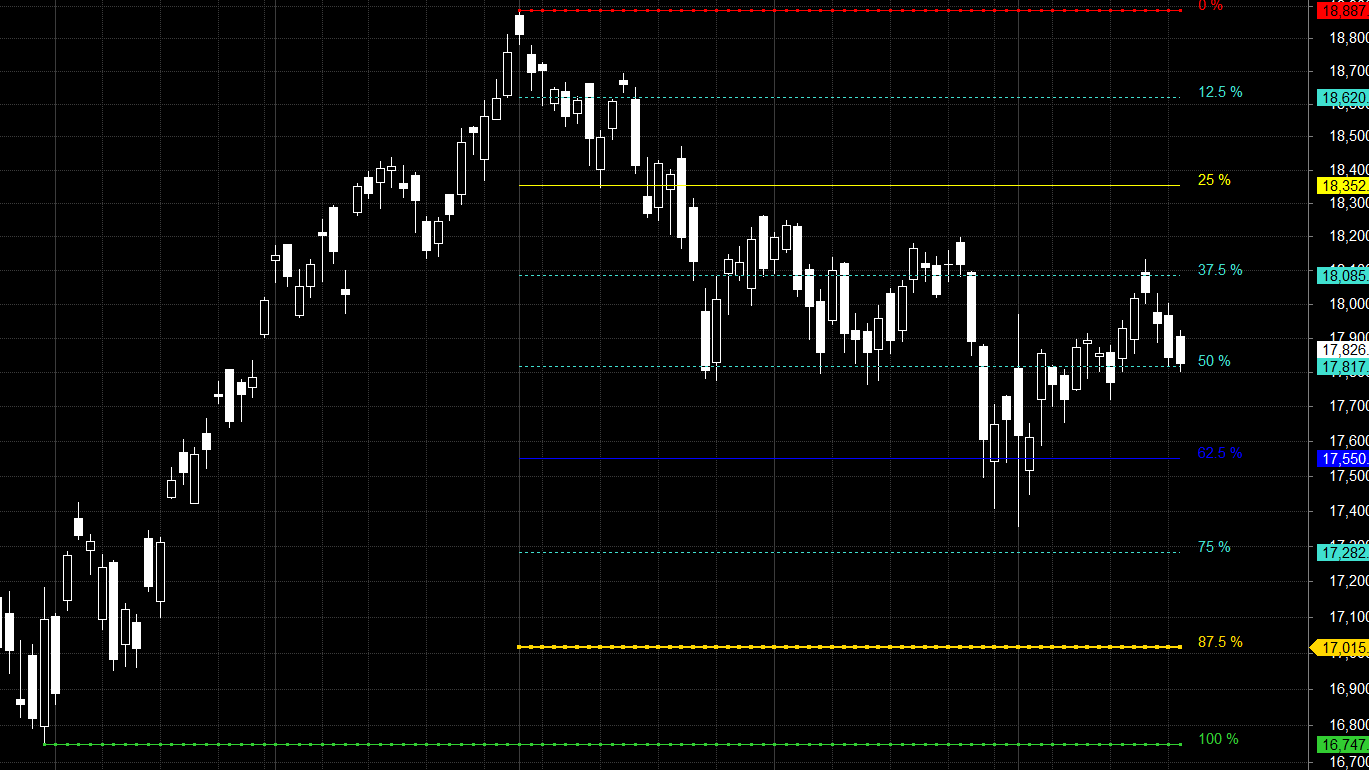

Nifty is back to its 50% point 17817 price has been in sideways move trading between 37.5-50-62.5 range. Nifty has closed just at its 20 DMA, Its tough time for trend followers as market are lacklusture. As a trader we need to adjust as per market moves.Bayer Rule 6: The price is in bottom/top when Mars was in 16 degrees 35 minutes of some sign and plus 30 degrees. will come into effect tommorow so first 15 mins High and Low will guide for the day.

Position sizing:

- “Sideways market”, it should be 25% of total and for 50 to 100 points as per the trading range expected or already established and you should initiate trades based on the levels with discipline and never in the middle of the range. Above all “trade” during this period.

- “Trending market”(Either up or down), it should be 75% of total as positional and for maximum gains till the new astro/gann date confluence is seen.

- “Narrow choppy market” when volatility is at its lowest, trade for 25 to 35 points and at times you may be holding positional during such periods and it will be a testing time but you must sit through this.

Our ability to discriminate these three different periods and the courage to act on such a knowledge will make the difference from an average trader to an outstanding one.

Nifty has formed an NR7 pattern today Trade Plan as below.

Intraday time for reversal can be at 9:15/10:55/11:41/12:47/2:42 How to Find and Trade Intraday Reversal Times

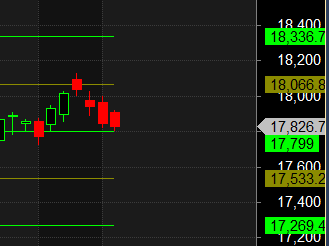

MAX Pain is at 17900 PCR at 1.03 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Maximum Call open interest of 26 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 23 lakh contracts was seen at 17800 strike, which will act as a crucial Support level

FII’s bought 525 cores and DII’s sold 235 cores in cash segment.INR closed at 82.60

#NIFTY50 as per musical octave trading path can be 18066-17800-17533 take the side and ride the move !!

Understand that you will lose on more trades than you will win on; that is just part of the game. If you are the type that always has to be “right” you are going to have a hard time becoming a successful trader. The market is perpetual, it continues on no matter what you think about it with no knowledge that you exist.

Positional Traders Trend Change Level is 17853 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 17867will act as a Intraday Trend Change Level.