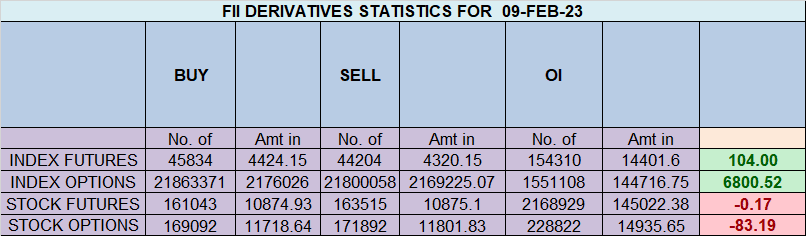

FII bought 1.6 K contract of Index Future worth 104 cores, Net OI has decreased by 1.7 K contract 63 Long contract were covered by FII and 1.6 K Shorts were covered by FII. Net FII Long Short ratio at 0.23 so FII used rise to

exit Long and exit short in Index Futures.

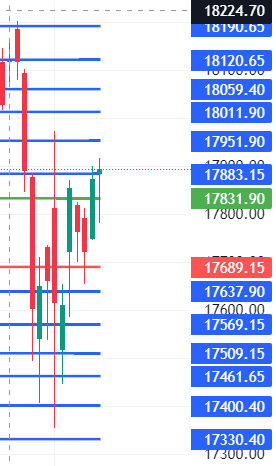

As Discussed in Last Analysis Nifty has formed Bullish Engulfing near 50% Point as shown below, With Overhang of RBI Policy over any move above 17860-17872 can lead to fast move towards 17972 Budget day High . Moon at Zero Declination tommrow so nifty can see decent move first 15 mins High and low will guide for the day.

Another day for a close above 50% point and DOJI formation on Daily candel but price is able to close above 20 DMA, Weekend Mercury Ingress is happening as Mercury is moving in Aquarius so next 2 days impact will be shown.You should look at the market at all times like a BULL and like a BEAR and this will keep you vigilant and allows you to book profits and reverse your trades or simply stay off the markets. Sometimes “Doing nothing” is the best thing.

Nifty BUlls have closed above 17832 now waiting for 17951/18011.

Intraday time for reversal can be at 9:23/11:14/1:21/2:30 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17900 PCR at 0.83 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Maximum Call open interest of 30 lakh contracts was seen at 178000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 20 lakh contracts was seen at 17700 strike, which will act as a crucial Support level

Nifty Feb Future Open Interest Volume is at 0.99 Cr with liquidation of 1.76 Lakh with increase in Cost of Carry suggesting Long positions were closed today.

Nifty Rollover cost @18169 and Rollover % @75 Closed below it.

Nifty Bulls now need to hold 17811 for trend to remain buy on dips.

FII’s sold 144 cores and DII’s sold 205 cores in cash segment.INR closed at 82.60

#NIFTY50 as per musical octave trading path can be 17884-18152 take the side and ride the move !!

Those who succeed big at anything all have the same attitude: You keep going until it happens or you die trying. Quitting is not an option.

Positional Traders Trend Change Level is 17804 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 17906 will act as a Intraday Trend Change Level.