On 28 Jan we had Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes., So till 29 Jan Low 39419 we are heading upside. Watch for 3 PM candel tommrow for a SPIKE in Price. We have monthly close tommorow and Bank Nifty 40700-40758 zone.

Union Budget 2023: How Bank Nifty moved Past 19 Budget

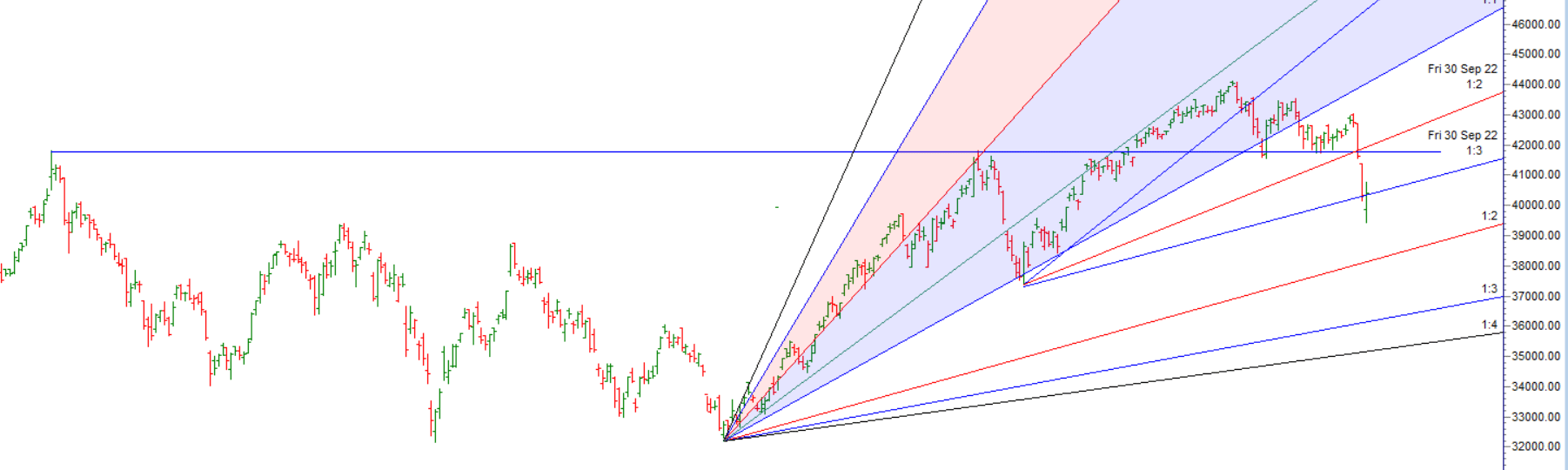

Plan for next 2 session based on Ratio Indicator

Long above 40809 for a move towards 41371/42124/42782/43302

Short Below 39399 for a move towards 38837/38084/37426

Intraday time for reversal can be at 9:36/10:14/11:03/12:05/1:59/2:23/3:00 How to Find and Trade Intraday Reversal Times

Bank Nifty Feb Future Open Interest Volume is at 26.3 lakh with addition of 2.1 Lakh contract , with increase in Cost of Carry suggesting LOng positions were added today.

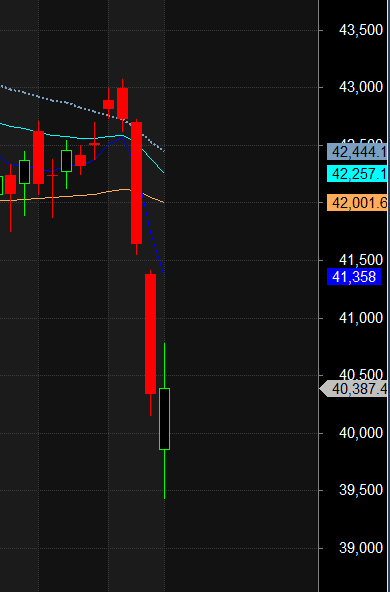

Bank Nifty Rollover cost @42742 and Rollover % @77 Closed below it,

Bank Nifty Bulls now need to move above 41358

Maximum Call open interest of 17 lakh contracts was seen at 41000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 18 Lakh contracts was seen at 40000 strike, which will act as a crucial Support level.

MAX Pain is at 41000 and PCR @0.98 . Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

We need to evolve and practices to think like trader

For Positional Traders Trend Change Level is 41171 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 40452 will act as a Intraday Trend Change Level.