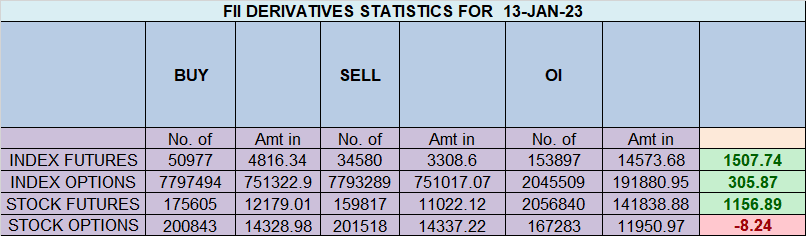

FII bought 5.7 K contract of Index Future worth 1507 cores, Net OI has decreased by 4.5 K contract 5.9 K Long contract were added by FII and 10.4 K Shorts were covered by FII. Net FII Long Short ratio at 0.76 so FII used ride to enter Long and exit short in Index Futures.

Today again we have Multiple Declination of Jupiter and Moon combined with Gann Date and also Mars Declination tommrow as discussed in below video. Multiple Doji are formed in NIfty at Octave Point so should see trending move as Multiple Astro and Gann Events are confluencing.

We saw positive move in Nifty and price has closed above 2 days High,Price now need to close above 18066 for a positive traction to take place next week, We are completing mercury retrograde today so till we are holding 17800 on closing basis Price can move on upside at 18233/18323.

For Swing Traders Bulls need to move above 17974 for a move towards 18040/ 18107/18174/18240. Bears will get active below 17804 for a move towards 17737/17670/17602

NIfty is stuck in range of its 50/100 DMA

MAX Pain is at 17900 PCR at 0.95 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Maximum Call open interest of 30 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 22 lakh contracts was seen at 17800 strike, which will act as a crucial Support level

Retailers have bought 674 K CE contracts and 776 K CE contracts were shorted by them on Put Side Retailers bought 113 K PE contracts and 101 K PE shorted contracts were added by them suggesting having BEARISH outlook.

FII bought 179 K CE contracts and 152 K CE were shorted by them, On Put side FII’s bought 135 K PE and 157 K PE were shorted by them suggesting they have a turned to neutral Bias.

Nifty Jan Future Open Interest Volume is at 1.18 Cr with addition of 2.2 Lakh with increase in Cost of Carry suggesting Long positions were addded today.

Nifty Rollover cost @18178 and Rollover % @72.5 Closed below it.

Nifty has again bounced from 50% point now need close above 18066 for trend to change from SELL of RISE to BUY on DIPS.

FII’s sold 2422 cores and DII’s bought 1953 cores in cash segment.INR closed at 81.40

#NIFTY50 as per musical octave trading path can be 17538-17804-18072 take the side and ride the move !!

One of the reason why beginners trader blow up their trading account and have to leave trading forever is that they are extremely undercapitalized. They are forced out due to market noise

Positional Traders Trend Change Level is 18101 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 17972 will act as a Intraday Trend Change Level.