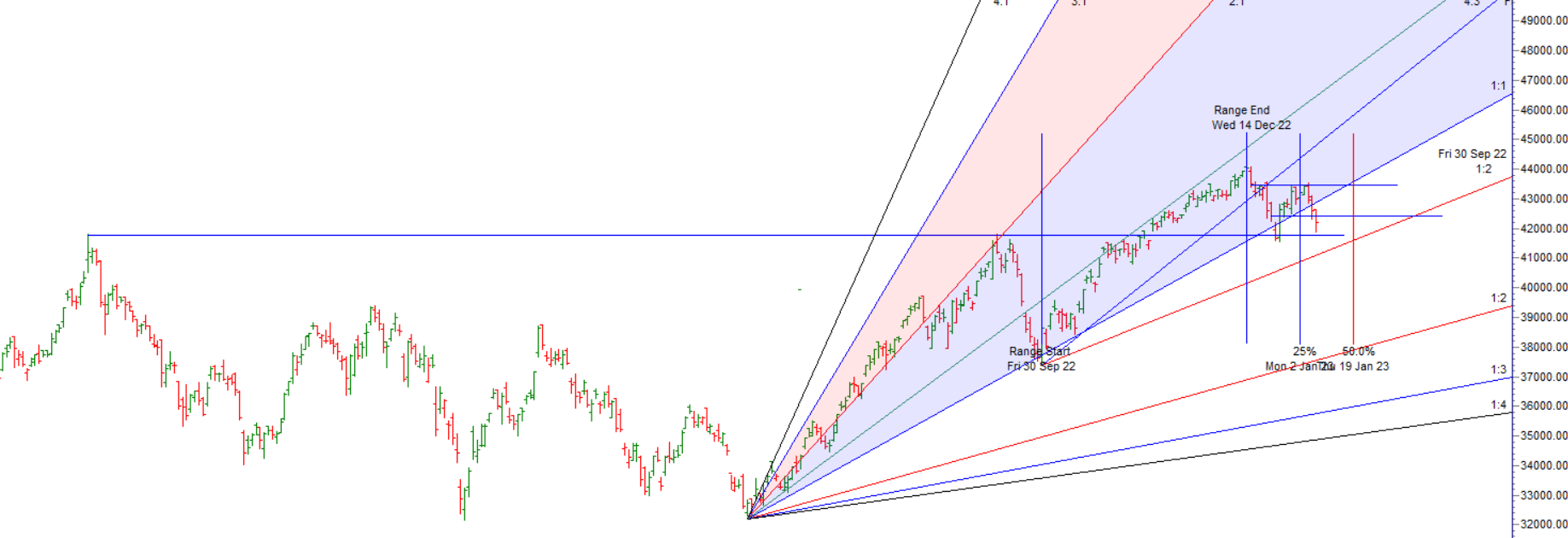

SUN Trine Uranus is very important aspect, If yesterday low of markets are held we can see sharp upmove as multiple lunar aspet and Bayers rule are coming in weekend. Also price is back to 42489 which is mercury retrograde low and closed above it.

- Bayer Rule 22: The trend changes if retrograde Mercury passes over the Sun. Sun Conjuct Rx Mer

- MERCURY’S DAILY SPEED IN GEOCENTRIC LONGITUDE

- FULL MOON

- MOON DECLINATION

We will see impact of Astro Dates on Monday with Bank Nifty opening gap up, Will we sustain the gap 15 mins High and Low will decide. Price has again bounced from 41840 previous resistance becoming support.

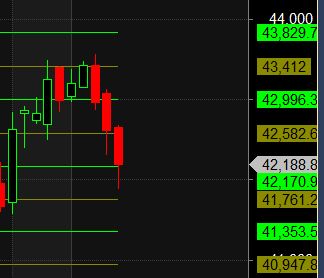

. Bears will get active below 42534 for a move towards 42325/42117/41908. — All 3 target done.

For Swing Traders Bulls need to move above 42490 for a move towards 42695/42900/43104/43309. Bears will get active below 42286 for a move towards 42081/41877.

Intraday time for reversal can be at 9:15/11:30/12:27/2/2:37 How to Find and Trade Intraday Reversal Times

Bank Nifty Jan Future Open Interest Volume is at 23.5 lakh with liquidation of 0.37 Lakh contract , with increase in Cost of Carry suggesting Long positions were closed today.

Bank Nifty Rollover cost @42890 and Rollover % @80.4 Closed below it,

Bank Nifty Bulls now need to hold 41997, it has bounced from this last time also.

Maximum Call open interest of 25 lakh contracts was seen at 42500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 25 Lakh contracts was seen at 42000 strike, which will act as a crucial Support level.

MAX Pain is at 42000 and PCR @0.75 . Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

By implementing contingency planning, you can take swift, decisive action the instant one of your positions changes its behaviour or is hit with an unexpected event.

For Positional Traders Trend Change Level is 43114 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 42402 will act as a Intraday Trend Change Level.