FII bought 16.5 K contract of Index Future worth 1478 cores, Net OI has decreased by 6.5 K contract 4.9 K Long contract were added by FII and 11.5 K Shorts were covered by FII. Net FII Long Short ratio at 0.69 so FII used fall to enter Long and exit short in Index Futures.

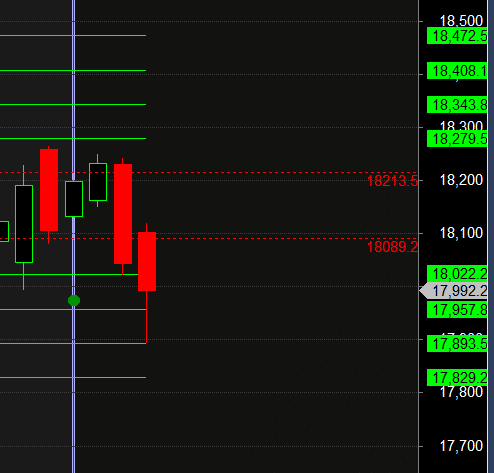

High made was 18243 so bulls unable to cross 18255 and Bears took upperhand. Tommrow SUN Trine Uranus is very important for World Indices, so we can see sharp reversal if we close above 9:30 High. First 15 mins High and Low will guide for Intraday.

SUN Trine Uranus is very important aspect, If yesterday low of markets are held we can see sharp upmove as multiple lunar aspet and Bayers rule are coming in weekend. Also price is back to 17992 which is mercury retrograde low and closed at it.

- Bayer Rule 22: The trend changes if retrograde Mercury passes over the Sun. Sun Conjuct Rx Mer

- MERCURY’S DAILY SPEED IN GEOCENTRIC LONGITUDE

- FULL MOON

- MOON DECLINATION

Bears were able to do 18022, Till Nifty is below 18066 target are 17957/17893. All 2 target done.

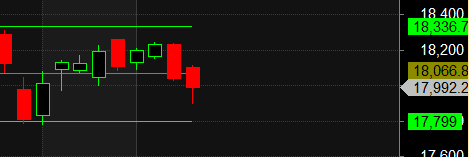

For Swing Traders Bulls need to move above 18066 for a move towards 18130/18197/18265. Bears will get active below 17927 for a move towards 17859/17792/17724.

MAX Pain is at 18000 PCR at 1.05 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Maximum Call open interest of 12 lakh contracts was seen at 18100 strike, which will act as a crucial resistance level and Maximum PUT open interest of 12 lakh contracts was seen at 18000 strike, which will act as a crucial Support level

Nifty Jan Future Open Interest Volume is at 1.11 Cr with addition of 0.09 Lakh with increase in Cost of Carry suggesting Long positions were added today.

Nifty Rollover cost @18178 and Rollover % @72.5 Closed below it.

Nifty has again bounced from 50 DMA.

FII’s sold 1449 cores and DII’s sold 194 cores in cash segment.INR closed at 81.57

#NIFTY50 as per musical octave trading path can be 17799-18066-18336 take the side and ride the move !!

The market works on probability as it is a confluence of all trader activity. So when the probability is tilted on one side, you will see action on that side. When there is pressure on the opposite side, the movement happens accordingly.

Positional Traders Trend Change Level is 18203 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18077 will act as a Intraday Trend Change Level.

Ati uttam Happy New Year to our Sir