FII sold 6.2 K contract of Index Future worth 650 cores, Net OI has increased by 3.7 K contract 1.2 K Long contract were covered by FII and 5 K Shorts were added by FII. Net FII Long Short ratio at 0.84 so FII used fall to exit Long and enter short in Index Futures.

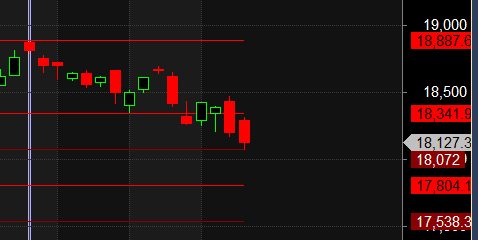

Plan worked perfectly Nifty opened gap up broke 15 mins high and there was no looking back, For Swing traders its been diffcult days but if market gives money it has to take some also.As trader we cannot be prisoners of our own view, we need to change as price action changes and follow rules. Fall has been brutal in nifty and we are approaching gann angle support near 18100-18115 from where price has bounced multiple time . Every year around 20-21 Dec We see this kind of fall. On Upside 18278-18300 is important supply zone.

Bayer Rule 31: The trend changes when Venus in declination reached an extreme beyond 23 degrees 26 minutes 51 seconds and we have New Moon also. we are approaching 18000 important zone of support as per below gann chart from where we can see a small bounce.

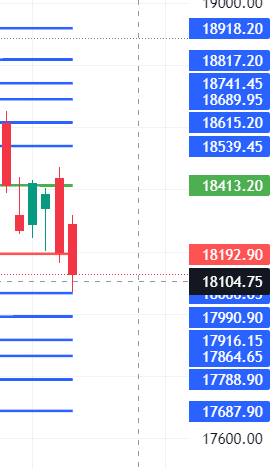

Swing Plan Bulls need to move above 18440 for a move towards 18539/18616/18741 . Bears will get active below 18192 for a move towards 18066/17990/17916. — 18066 done now waiting for 17990/17916.

MAX Pain is at 18100 PCR at 0.75 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05. PCR is very Weak for Bank Nifty

Maximum Call open interest of 52 lakh contracts was seen at 18300 strike, which will act as a crucial resistance level and Maximum PUT open interest of 42 lakh contracts was seen at 18000 strike, which will act as a crucial Support level

Nifty Dec Future Open Interest Volume is at 0.99 Cr with liquidation of 2.2 Lakh with increase in Cost of Carry suggesting SHORT positions were closed today.

Nifty Rollover cost @18392 and Rollover % @75.1 Closed above it.

Till Nifty is below 18298 on closing basis Bears will have upper hand.

FII’s bought 928 cores and DII’s bought 2206 cores in cash segment.INR closed at 81.61

#NIFTY50 as per musical octave trading path can be 18341-18072-17804 take the side and ride the move !!

In leveraged trades, it is how you manage risk that eventually decides if you hang on to your profits or proceed to lose it all.

Positional Traders Trend Change Level is 18629 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18202 will act as a Intraday Trend Change Level.