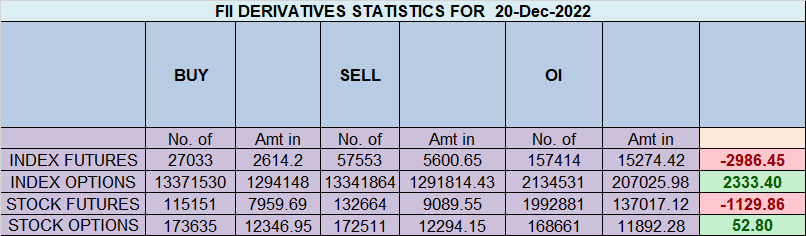

FII bought 30.5 K contract of Index Future worth 2986 cores, Net OI has increased by 3.1 K contract 13.6 K Long contract were covered by FII and 16.8 K Shorts were added by FII. Net FII Long Short ratio at 0.97 so FII used fall to exit Long and exit short in Index Futures.

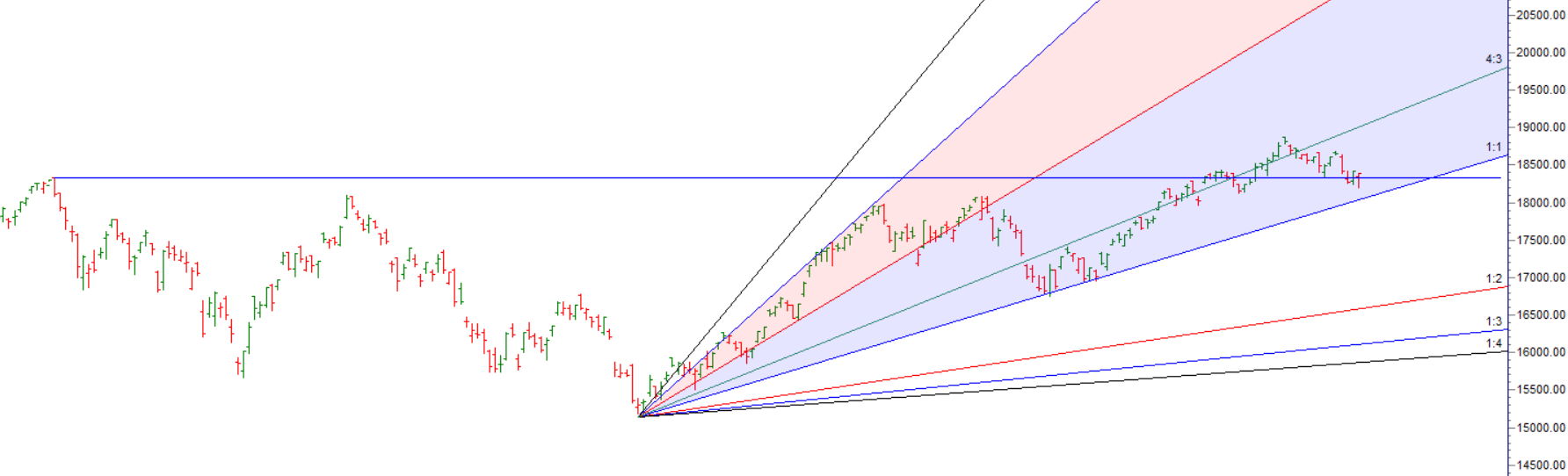

We have Jupiter Ingress today as discussed in below video price is back above 18351 seems like falase breakdown and today we have important gann date also so we should see good move in next 2 trading session.

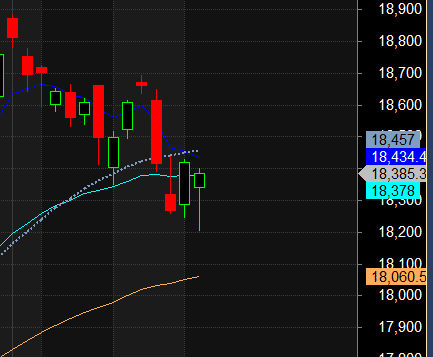

Price saw a similar Price action like last year as both Gann and Astro Date confluenced correction in first half and full recvery in 2 half, Today if price move above 18434-18440 than late shorts which entered yesterday could lead to big short covering. Mercury has important role to play in Nifty and today Mercury at Greatest Elong: 20.1°E, Also price has closed above 18351 Jan 2022 High 2 days in row. Also we have Gann Rule In a highly uptrending market weekly low is achieved on Tuesday.

Today we have following Astro Events

- Sun Ingress

- Jupiter Square Sun

- Mercury at Greatest Elong: 20.1°E

- Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes

First 15 mins High and Low will guide for the day for Intraday Traders.

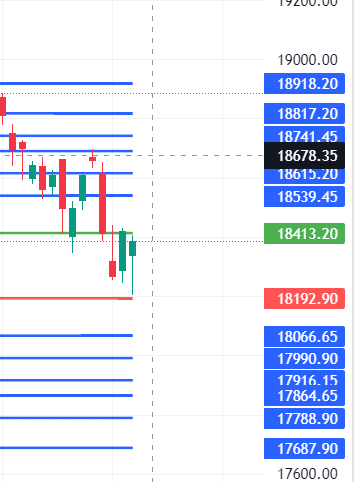

Swing Plan Bulls need to move above 18440 for a move towards 18539/18616/18741 . Bears will get active below 18192 for a move towards 1806/17990/17916.

MAX Pain is at 18500 PCR at 0.92 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05. PCR OI closed today at 0.90 as Nifty bounced back from 18200 levels.

Retailers sold bought 47 K CE contracts and 55.7 K CE contracts were shorted by them on Put Side Retailers sold 209 K PE contracts and 117 K PE shorted contracts were added by them suggesting having BEARISH outlook.

FII sold 47.7 K CE contracts and 55 K CE were shorted by them, On Put side FII’s bought 13.5 K PE and 22.9 K PE were shorted by them suggesting they have a turned to BULLISH Bias.

Maximum Call open interest of 52 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 52 lakh contracts was seen at 18300 strike, which will act as a crucial Support level

Nifty Dec Future Open Interest Volume is at 1 Cr with liquidation of 0.14 Lakh with increase in Cost of Carry suggesting Long positions were closed today.

Nifty Rollover cost @18392 and Rollover % @75.1 Closed above it.

Till Nifty is below 18434 on closing basis Bears will have upper hand.

FII’s bought 455 cores and DII’s bought 494 cores in cash segment.INR closed at 81.61

#NIFTY50 as per musical octave trading path can be 17744-18272-19800 take the side and ride the move !!

Those who rid themselves of their egos are rewarded greatly. They are the superstars of their fields. In the market, rewards come in the form of profits. In the world of art, masterpieces are the results. In sports, the players are all-stars and command enormous salaries. Every pursuit has its own manifestation of victory over the ego.

Positional Traders Trend Change Level is 18667 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18328 will act as a Intraday Trend Change Level.