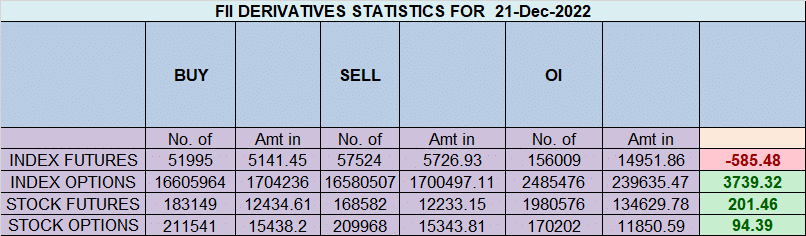

FII sold 5.5 K contract of Index Future worth 585 cores, Net OI has decreased by 1.4 K contract 3.4 K Long contract were covered by FII and 2 K Shorts were added by FII. Net FII Long Short ratio at 0.90 so FII used fall to exit Long and exit short in Index Futures.

Price saw a similar Price action like last year as both Gann and Astro Date confluenced correction in first half and full recvery in 2 half, Today if price move above 18434-18440 than late shorts which entered yesterday could lead to big short covering. Mercury has important role to play in Nifty and today Mercury at Greatest Elong: 20.1°E, Also price has closed above 18351 Jan 2022 High 2 days in row. Also we have Gann Rule In a highly uptrending market weekly low is achieved on Tuesday.

Today we have following Astro Events

- Sun Ingress

- Jupiter Square Sun

- Mercury at Greatest Elong: 20.1°E

- Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes

First 15 mins High and Low will guide for the day for Intraday Traders.

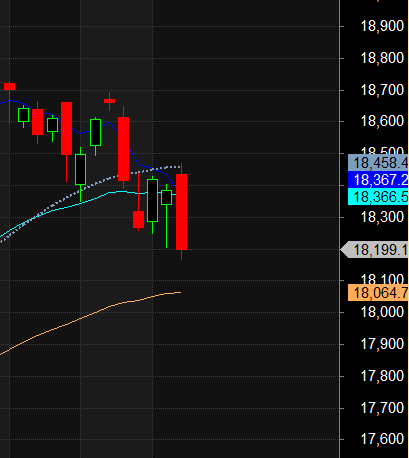

Plan worked perfectly Nifty opened gap up broke 15 mins high and there was no looking back, For Swing traders its been diffcult days but if market gives money it has to take some also.As trader we cannot be prisoners of our own view, we need to change as price action changes and follow rules. Fall has been brutal in nifty and we are approaching gann angle support near 18100-18115 from where price has bounced multiple time . Every year around 20-21 Dec We see this kind of fall. On Upside 18278-18300 is important supply zone.

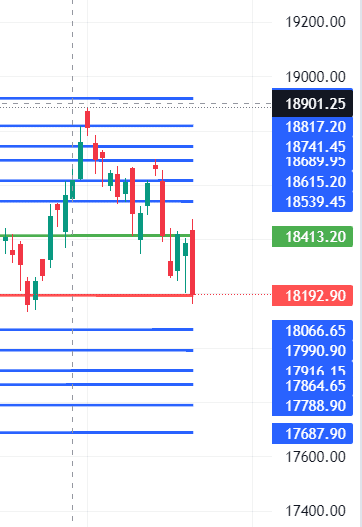

Swing Plan Bulls need to move above 18440 for a move towards 18539/18616/18741 . Bears will get active below 18192 for a move towards 18066/17990/17916.

MAX Pain is at 18500 PCR at 0.48 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05. PCR is very Weak for Bank Nifty

Retailers bought 169 K CE contracts and 137 K CE contracts were shorted by them on Put Side Retailers sold 44 K PE contracts and 28 K PE shorted contracts were added by them suggesting having BEARISH outlook.

FII bought 157 K CE contracts and 180 K CE were shorted by them, On Put side FII’s bought 30 K PE and 13 K PE were shorted by them suggesting they have a turned to NEUTRAL Bias.

Maximum Call open interest of 52 lakh contracts was seen at 18300 strike, which will act as a crucial resistance level and Maximum PUT open interest of 42 lakh contracts was seen at 18100 strike, which will act as a crucial Support level

Nifty Dec Future Open Interest Volume is at 1.02 Cr with addition of 1.44 Lakh with increase in Cost of Carry suggesting SHORT positions were added today.

Nifty Rollover cost @18392 and Rollover % @75.1 Closed above it.

Till Nifty is below 18367 on closing basis Bears will have upper hand.

FII’s sold 1119 cores and DII’s bought 1757 cores in cash segment.INR closed at 81.61

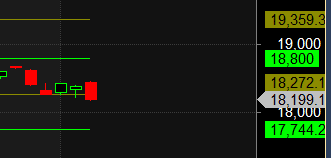

#NIFTY50 as per musical octave trading path can be 17744-18272-19800 take the side and ride the move !!

To perform well in the markets you need more than just skills, knowledge and a strategy with an edge or some competitive advantage. You need to have a mindset that is resilient, that allows you to take risk, navigate uncertainty, manage the pressures and stresses of the trading environment and its results orientation.

Positional Traders Trend Change Level is 18667 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18328 will act as a Intraday Trend Change Level.