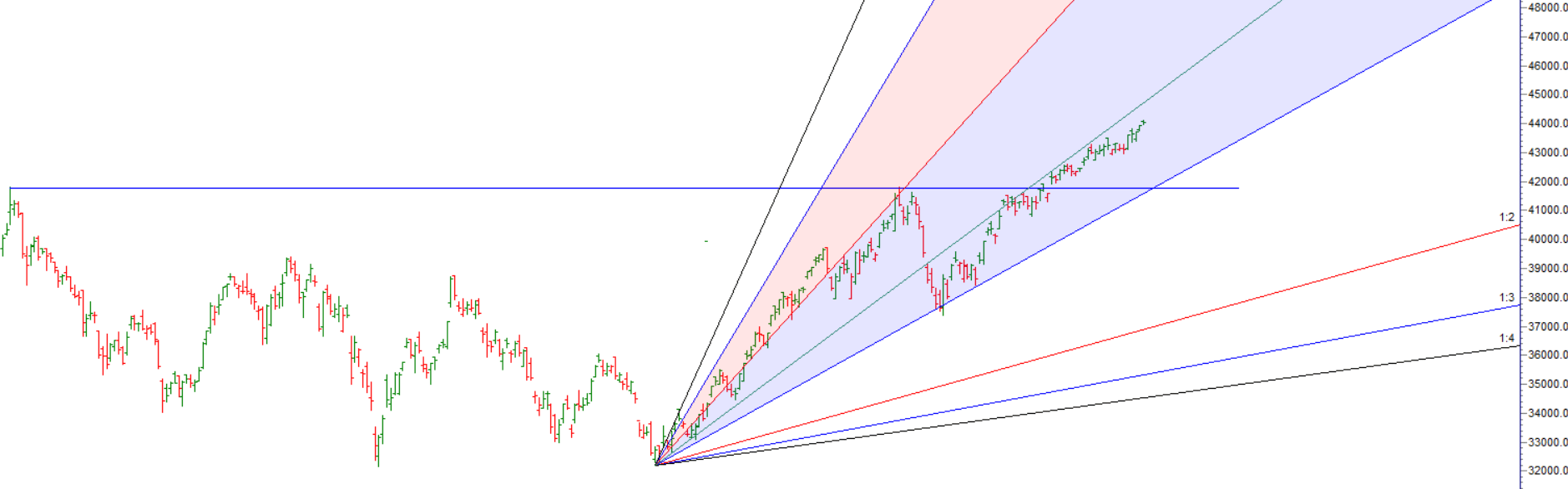

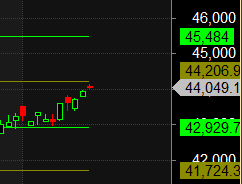

Bank Nifty contiue to march higher, heading towards the crucial supply zone of 44206. Last night we have seen classic case of buy rumour and sell news in dow. Trade on levels and Strict SL and carry overnight positions with Hedge only.

Federal Reserve raises interest rate by 0.50 percentage point to curb inflation and sees steeper hikes ahead, The hike is expected to ripple through the economy, driving up rates for credit cards, home equity lines of credit, adjustable rate mortgages and other loans. But Americans, especially seniors, are finally benefitting from higher bank savings yields after years of paltry returns.

Bank Nifty continue to march higher and formed an NR7 pattern, we will open slight gap down today, First 15 mins High and low will decide trend for the day as Mercury Trine North Node, North Node brings volatlity in the market so today we might see some volatile move. Use Swing and Intraday Level as mentioned.

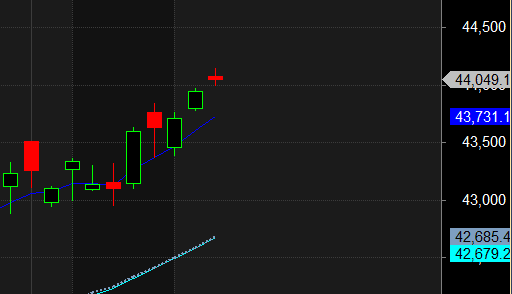

Fresh Swing Plan based on Astro Date Bulls need to move above 43788 for a move towards 43983/44177/44372/44566 . Bears will get active below 43356 for a move towards 43161/42967/42772. — 44177 done now waiting for 44372/44566

Intraday time for reversal can be at 10:24/11:15/12:15/1:01/2 How to Find and Trade Intraday Reversal Times

Bank Nifty Dec Future Open Interest Volume is at 30.3 lakh with addition of 0.39 Lakh contract , with increase in Cost of Carry suggesting Long positions were added today.

Bank Nifty Rollover cost @42828 and Rollover % @81.3 Closed above it, Bank NIfty Future is in premium has reduced towards 205 points.

Till Bank Nifty is above 43731 on closing basis Bulls will have upper hand.

Maximum Call open interest of 40 lakh contracts was seen at 44000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 46 lakh contracts was seen at 43600 strike, which will act as a crucial Support level.

MAX Pain is at 44000 and PCR @1.01 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

In trading, the objective is to win swiftly whenever possible. It is all about knowing how to handle the trade in accordance with the trading strategy and time frame

For Positional Traders Trend Change Level is 43527 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 44183 will act as a Intraday Trend Change Level.