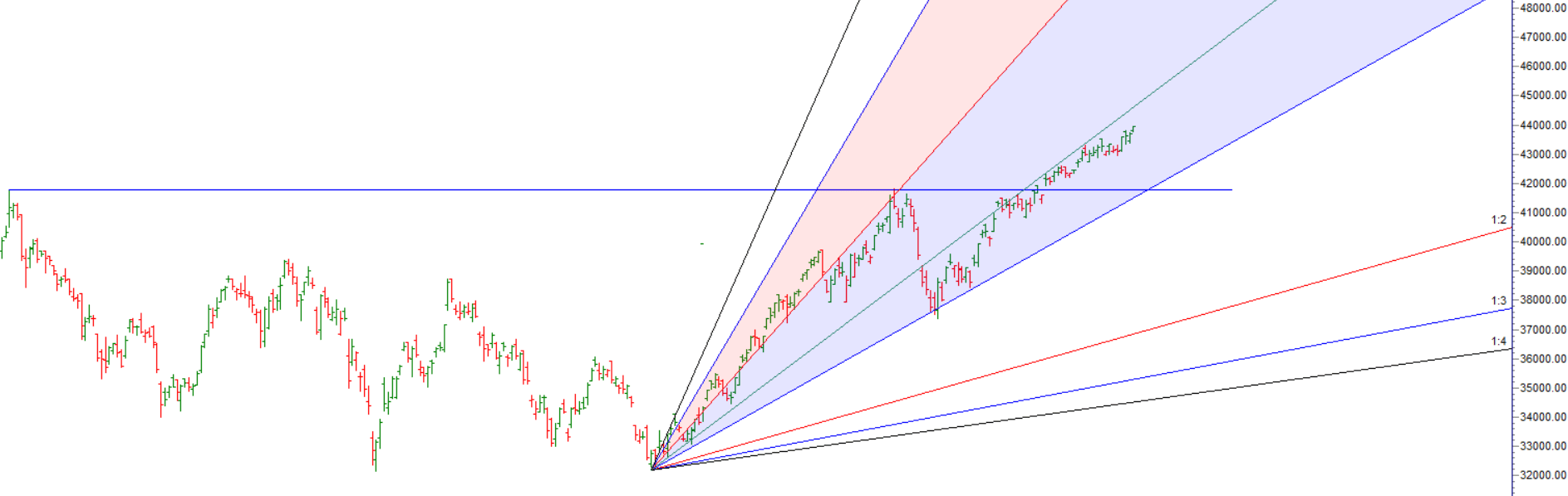

Bank NIfty is in strong bull trend any dips is getting bought into. “RULE NO. 38 MERCURY LATITUDE HELIOCENTRIC Some mighty fine tops and bottoms are produced when Mercury in this motion passes the above mentioned degrees 0, 3*21,6*42, and 7*0’”

If today low is held we can see move towards 44000.

Bank Nifty contiue to march higher, heading towards the crucial supply zone of 44206. Last night we have seen classic case of buy rumour and sell news in dow. Trade on levels and Strict SL and carry overnight positions with Hedge only.

Fresh Swing Plan based on Astro Date Bulls need to move above 43788 for a move towards 43983/44177/44372/44566 . Bears will get active below 43356 for a move towards 43161/42967/42772. — 43983 done now waiting for 44177/44372/44566

Intraday time for reversal can be at 9:21/10:24/11:40/12:33/1:04/2:32 How to Find and Trade Intraday Reversal Times

Bank Nifty Dec Future Open Interest Volume is at 29.9 lakh with addition of 1.79 Lakh contract , with increase in Cost of Carry suggesting Long positions were added today.

Bank Nifty Rollover cost @42828 and Rollover % @81.3 Closed above it, Bank NIfty Future is in premium has reduced towards 205 points.

Till Bank Nifty is above 43603 on closing basis Bulls will have upper hand.

Maximum Call open interest of 30 lakh contracts was seen at 44000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 36 lakh contracts was seen at 43500 strike, which will act as a crucial Support level.

MAX Pain is at 44000 and PCR @1.01 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

In trading, the objective is to win swiftly whenever possible. It is all about knowing how to handle the trade in accordance with the trading strategy and time frame

For Positional Traders Trend Change Level is 43480 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 44028 will act as a Intraday Trend Change Level.