We saw a decent fall in bank nifty now tommrow Neptune Turns Direct. Neptune is an outer plannet,This planet can be tricky and must be watched carefully. Price has also broken gann angle level. Also we have imporatnt Mercury Conjuct Venus Helio aspect which is important turning point.

Bank Nifty saw a decent decline in intraday and saw a swift recovery also, a typical charecterstic of Neptune plannet (This planet can be tricky and must be watched carefully). Price for 2 day has closed below gann angle. Today Mars is going in extreme declination. Mars Plannet adds energy to the trading of a stock and generally leads to trending move.

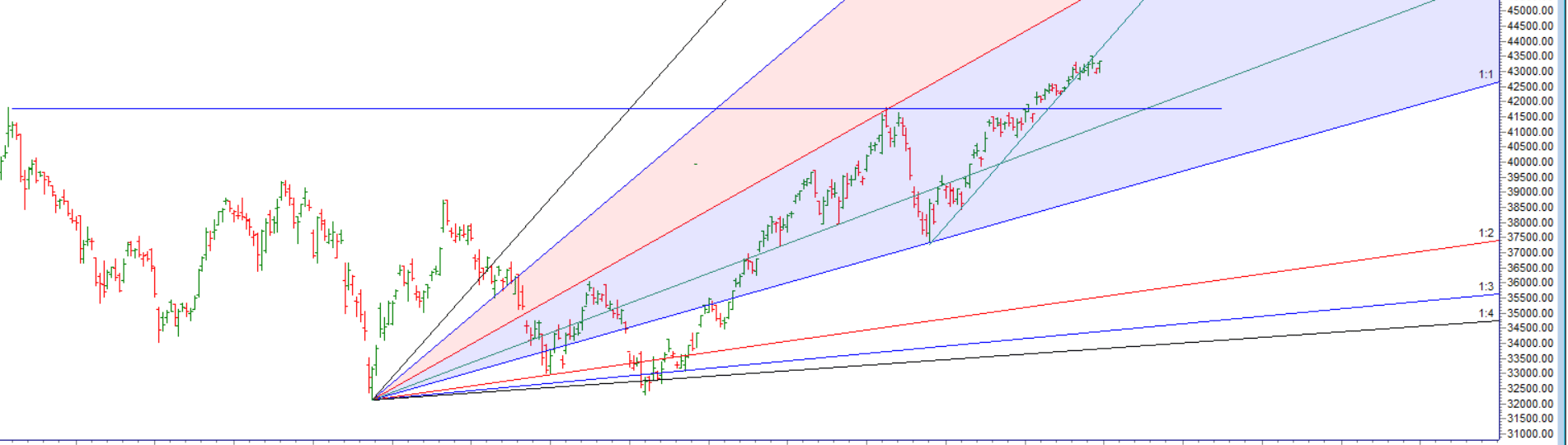

For Swing Trade Bulls need to move above 43400 for a move towards 43607/43814/44021 . Bears will get active below 43163 for a move towards 42955/42747/42539.

Intraday time for reversal can be at 9:38/11:18/12:45/1:34/2:26 How to Find and Trade Intraday Reversal Times

Bank Nifty Dec Future Open Interest Volume is at 29.1 lakh with addition of 1.9 Lakh contract , with increase in Cost of Carry suggesting short positions were added today.

Bank Nifty Rollover cost @42828 and Rollover % @81.3 Closed above it, Bank NIfty Future is in premium has reduced towards 205 points.

Till Bank Nifty is above 43147 on closing basis Bulls will have upper hand.

Maximum Call open interest of 28 lakh contracts was seen at 43500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 34 lakh contracts was seen at 43000 strike, which will act as a crucial Support level.

MAX Pain is at 43300 and PCR @0.91 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Those who choose to win seek successful role models, develop a road map for success, and accept setbacks as valuable teachers. They put a plan into action, learn from their results, and make adjustments until they achieve victory

For Positional Traders Trend Change Level is 43339 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 43421 will act as a Intraday Trend Change Level.