FII sold 3.9 K contract of Index Future worth 408 cores, Net OI has decreased by 1.6 K contract 2.9 K Long contract were covered by FII and 1 K Shorts were added by FII. Net FII Long Short ratio at 1.77 so FII used rise to enter long and exit short in Index Futures.

Tommrow we have Mercury Ingress and Today we have Venus Ingress Both moving in Sagittarius, As per W D Gann Double ingresses (when two or more planets, not counting the Moon, enter a new sign within two consecutive days) market tend to see big move. Nifty is making Higher High, Always Remmber Market follow path of least resistance Mind and heart will say lets short as Nifty has rallied 2000 points without major correction but till the system do not give signal aviod shorting else money will be lost. Either wait on sideline or be long till we do not close below previous day low.

The range this week has been just 160 points. IF this range sustains then this will be the narrowest weekly range in last 2 years.

Nifty Swing Trade Plan based on Astro Date High and Low is as below. For Swing Traders Bulls will get active above 18426 for a move towards 18492/18531/18570/18596 . Bears will get active below 18303 for a move towards 18238/18199/18160.

Intraday time for reversal can be at 9:38/10:28/11:14/12:32/1:23/2:17 How to Find and Trade Intraday Reversal Times

MAX Pain is at 18400 PCR at 0.85 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 22 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 24 lakh contracts was seen at 18200 strike, which will act as a crucial Support level

Nifty Nov Future Open Interest Volume is at 1.13 Cr with liquidation of 1.6 Lakh with decrease in cost of carry suggesting Long positions were closed today.

Till Nifty is above 18314 on closing basis Bulls will have upper hand.

FII’s bought 618 cores and DII’s bought 449 cores in cash segment.INR closed at 81.80

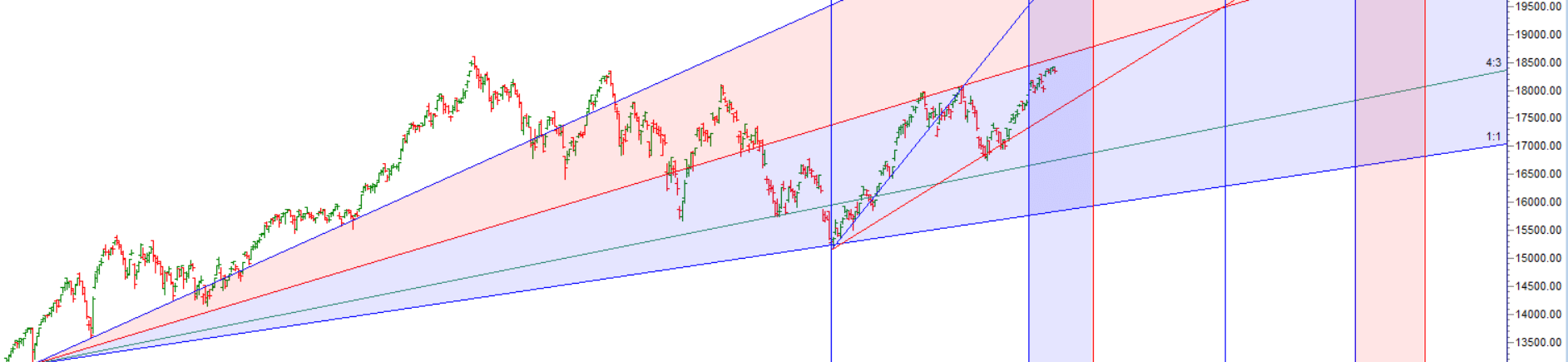

#NIFTY50 as per musical octave trading path can be 17551-18058-18595 take the side and ride the move !! 2 days in a row closed above 18058

Consider establishing some trading rules that can help you snap out of it when emotion comes into play. Of course, different rules apply to different traders depending on their trading strategies and goals, but some general ones can be applied in many situations.

Positional Traders Trend Change Level is 18186 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18412 will act as a Intraday Trend Change Level.