FII sold 12 K contract of Index Future worth 1092 cores, Net OI has increased by 8.4 K contract 1.7 K Long contract were covered by FII and 10.2 K Shorts were added by FII. Net FII Long Short ratio at 0.52 so FII used rise to exit long and enter short in Index Futures.

Intraday time for reversal can be at 9:15/9:52/11:01/12:14/1:00/2:36 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17800 PCR at 0.86 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 52 lakh contracts was seen at 17800 strike, which will act as a crucial resistance level and Maximum PUT open interest of 45 lakh contracts was seen at 17600 strike, which will act as a crucial Support level

Nifty Sep Future Open Interest Volume is at 1.01 Cores with liquidation of 1.98 Lakh with increase in cost of carry suggesting Long positions were closed today.

Nifty rollover cost @ 17655 and Rollover @76.6 % Closed above the rollover level suggesting bias is Bullish

FII’s sold 461 cores and DII’s bought 538 cores in cash segment.INR closed at 79.81

Retailers have bought 459 K CE contracts and 379 K CE contracts were shorted by them on Put Side Retailers sold 326 K PE contracts and 239 K PE shorted contracts were added by them suggesting having Bullish outlook.

FII bought 52.4 K CE contracts and 75.2 K CE were shorted by them, On Put side FII’s bought 36.1 K PE and 15.2 K PE were shorted by them suggesting they have a turned to neutral Bias.

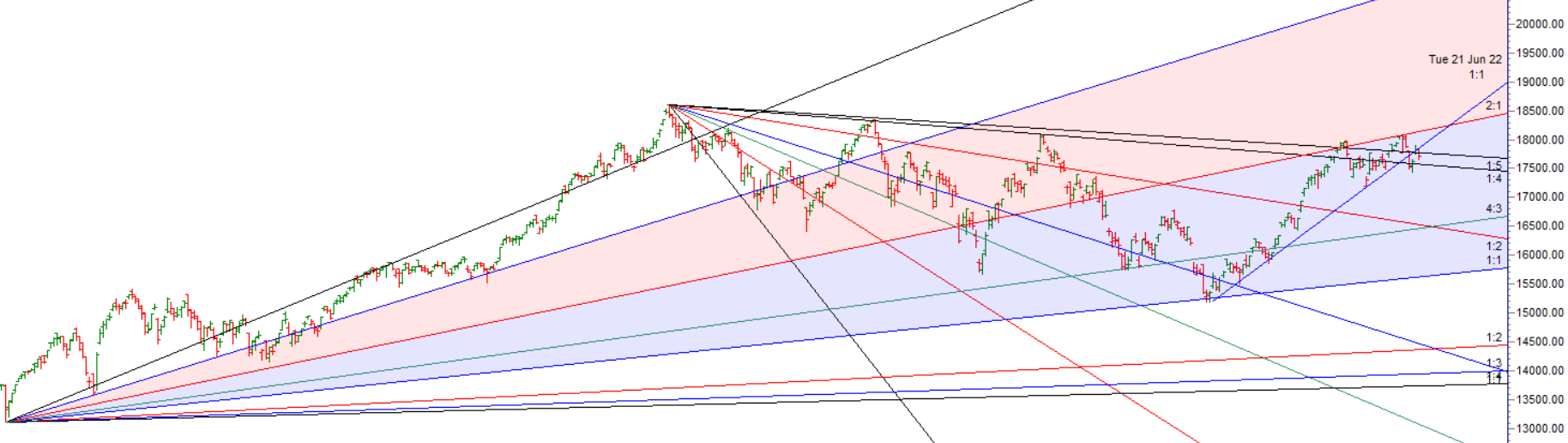

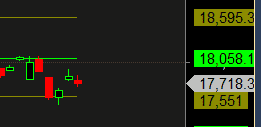

#NIFTY50 READY for another 500 points move as per musical octave 18595 – 18058 -17551 take the side and ride the move !!

When we increase the size of our positions, a funny thing happens. We usually begin to lose money. And a lot of it. It all depends on how you increase your size. Weight lifters gradually put more iron on the bar. They donít suddenly go from one hundred to three hundred pounds. They go in small increments. Our minds are very much like muscles. They can handle only a gradual increase in the risk that we assume in the market. Too sudden a shift in risk size disturbs our equilibrium and sense of the marketís ebbs and flows.