As Discussed in Last Analysis Tommorow we are completing 90 days from 08 March Bottom. Saturn Retrograde and Mercury Declination suggesting till 35048 is held Bulls have upper hand. For Swing Traders Bulls need to move above 35446 for a move towards 35634/35821/36008. Bears will get active below 34999 for a move towards 34859/34671/34483. Bank Nifty opened with gap down and closed below Saturn Retrograde low and able to do 1 target on downside. For Swing Traders Bulls need to move above 35133 for a move towards 35323/35513/35703. Bears will get active below 34820 for a move towards 34631/34441

RBI Policy outcome will come after 10:30 AM. Once the RBI Governor Stop speaking take position after that only, Till 10:39 AM we can see wild swings. Saturn is in Retrograde in Aquarius.Interest rates will go up for sure but it remains to be seen by how much.Any hike or any comment which indicates more than anticipated rate might dampen the mood further and could keep our markets in corrective mode. So just keep an eye your postions especially in F & O. However dip should be used to buy as the markets could bounce sharply as Moon goes Declination on 10 June.

Intraday time for reversal can be at 10:11/11:12/12:36/1:13/1:48 How to Find and Trade Intraday Reversal Times

Bank Nifty May Future Open Interest Volume is at 24.2 lakh with addition of 0.21 Lakh contract , with decrease in Cost of Carry suggesting Long positions were added today.

Bank Nifty rollover cost @ 34598 and Rollover @79.5 % Closed below it. Bank Nifty BUlls need to protect 35277 on Bank Nifty Futures tommrow. Low made 35290.

Maximum Call open interest of 16 lakh contracts was seen at 35500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 19 lakh contracts was seen at 34500 strike, which will act as a crucial Support level

MAX Pain is at 35000 and PCR @0.87 . PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets. So, after all the mayhem, we are probably returning to sanity is what is indicated by the rising PCR.

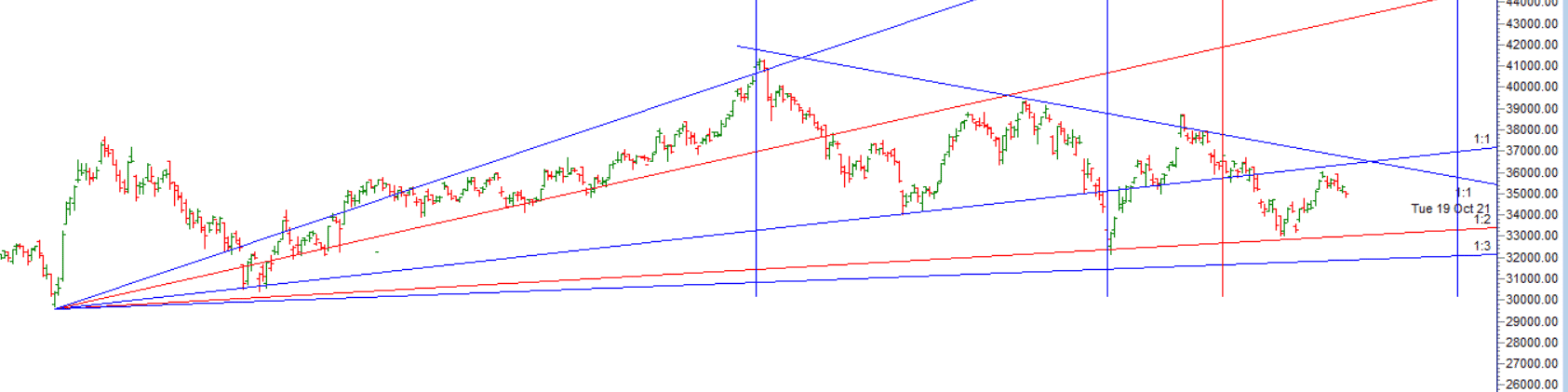

#BANKNIFTY closed above #gann Monthly TC Level of 35034 upmove can last till 35526/35758/35984/36179/36641 Any close below 35000 can lead to quick fall towards 34491. Today low was 34996 near tc level of 35034.

I know it may sound strange to many readers, but there is an inverse relationship between analysis and trading results. More analysis or being able to make distinctions in the market’s behaviour will not produce better trading results– Mark Douglas

For Positional Traders Trend Change Level is 35493 on Futures and go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 35071 will act as a Intraday Trend Change Level.