What Is a Drawdown?

A drawdown is a peak-to-trough decline during a specific period for trading account, or fund. A drawdown is usually quoted as the percentage between the peak and the subsequent trough. If a trading account has 100,000 in it, and the funds drop to 90,000 before moving back above 100,000, then the trading account witnessed a 10% drawdown.

Stock Markets around the world have been very volatile in last few months, Stocks are showing swings of 2-4 % every day which make it diffcult for traders to make money but lead to big losese. Even SL are getting skipped due to gap up and gap down.

This is the need of hour since many are going through a drawdown phase.

How to Recover a Drawdown

Cut Back Your Position Size: The first and foremost thing to do after a drawdown is to immediately cut your trading size. Otherwise you can make more losses. Cutting the size ensures no further damage and protects your account, buying you time to reflect. Take for example, how legendary trader Richard Denis thought the Turtles to handle drawdowns. When drawdowns occurred, they would reduce the trading size from 2% down to 1.6%. They would continue to cut back their position size if the DD was extending.This preventive action is for self-preservation of your capital.Learn it, and use it in your favor.

Avoid revenge trading: Revenge trading is similar to a condition poker players find themselves in – commonly called being ‘on tilt’. Strictly avoid the urge to recover all the losses quickly. In fact, the urge to revenge trade will further increase your losses. You may start taking unnecessary risks and trading impulsively. T

Focus on small wins Your goal when you restart your trading should never be to make big money. You should be focusing on small, but frequent wins. It gets you into the habit of winning which ultimately improves your mindset.

Know the Maximum Drawdown of Your Trading Strategy Through effective backtesting methods, you can actually discover the maximum DD of your trading strategy.

This will mentally prepare you for them.If a trader learns how to develop an awareness of what will happen to his account during a drawdown period, you’ll have the mental capacity to cope with the drawdown and stick with your trading strategy through these tough times.

Create A Trading Journal I keep a trading journal to assist me in my trading activities. Each success is recorded; more importantly, each failure is inked upon the pages like a confession. If there is one catalyst that has facilitated my progress as a trader, it is this little book of secrets. In essence, it represents a combination of mistakes, successes, and commitments to change and improve. The subsequent execution of this evolving script has given rise to my personal learning curve. Each learned gem helps to raise the trajectory of my equity curve, while each corrected mistake helps to buffer my periodic future drawdowns

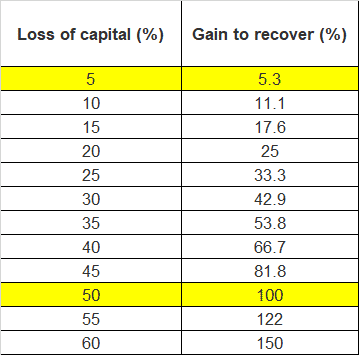

Manage risk There’s only one way to recover from a drawdown safely. You must carefully manage risk . You must stay calm, determined, and rational. You must work at a steady pace until you make enough profits to break even. Always Keep the below stats in mind.

Drawdowns happen to the best of us. But when every time you recover from a drawdown, your confidence will skyrocket. Drawdowns teach more lessons than winning streaks. Don’t forget to thank me if this thread helps you to bounce back from a drawdown.

We can use the below Exercise for improving concentration during drawdown period.

Exercise : Centering

Centering is a simple technique that you can use to control stress and muscle tension, block out negative or distracting thoughts, and refocus your attention on task-relevant cues.

Sit in a comfortable and upright position.

Legs and arms unfolded/uncrossed.

Take a deep breath in from the abdomen, and imagine the air circulating around the body.

Exhale slowly and completely, and as you do so feel your neck and shoulders relaxing, and this relaxation spreading through the rest of the body.

As you finish the breath, think about the single most important component to focus on right now

I find that by spending time on controlling my breathing I am able to stay more in control when things get tight.

We discuss more Excercises in our TRADING PSYCHOLOGY Course

Conclusion

Recognize that sustaining a severe drawdown is often a turning point in a traders’ career. While it can be a meaningful stepping stone towards longer-term improvement, it also puts the trader in a vulnerable situation. Do not just try to “shake it off” or “forget about it” and move on. Spend time and focus efforts on creating change and returning better off for it.

There is only one action that is advisable on the heels of a severe drawdown, and it is to take a break. Go and walk around the block. Resist the urge to trade again! Simply put, make sure that you do not further compound the damage by risking further losses. Unfortunately, what has happened is now in the past and entirely beyond your control. This means that on the heels of a severe drawdown, your focus must shift towards the present and the future. You should focus on the factors that you can—and must—control going forwards.