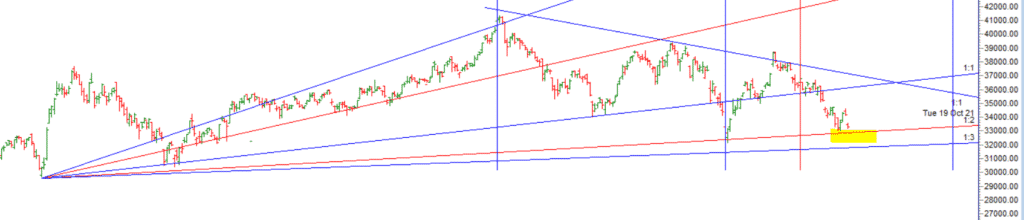

As Discussed in Last Analysis Tommrow we might open gap down Bears will get active below 34047 for a move towards 33864/33680.Bulls need to move above 34283 for a move towards 34469/34655. We Opened up with big gap down and today we are opening up with gap up For Swing traders LOngs above 33575 for a move towards 33728/33910/34091. Bears will get active below 33365 for a move towards 33183/33001. Sun is going to Gemni today so watch out for PSU banks.

Intraday time for reversal can be at 9:58/10:47/11:38/12:45/2:36 How to Find and Trade Intraday Reversal Times

Bank Nifty May Future Open Interest Volume is at 23.3 lakh with liquidation of 1.12 Lakh contract , with increase in Cost of Carry suggesting short positions were closed today.

Maximum Call open interest of 22 lakh contracts was seen at 34000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 21 lakh contracts was seen at 33000 strike, which will act as a crucial Support level

MAX Pain is at 33500 and PCR @0.88 Rollover cost @36221 closed below it and Rollover % @80 highest in last 3 months.

Last Expiry we closed at 33532 and Yesterday we closed at 33315 In Between we had a 1000-1200 points ride suggesting market is not going anywhere but hitting SL of traders.

Once prepared, enter the arena, start with the 1st round in a light commitment to “test the market” and grow to 2nd round and so on to complete your “ring exposure, experience to come out a winner”.

For Positional Traders Trend Change Level is 34733 on Futures and go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 33372 will act as a Intraday Trend Change Level.