FII sold 15.9 K contract of Index Future worth 357 cores, Net OI has increased by 1.8 K contract 5.4 K Long contract were covered by FII and 3.6 K Shorts were added by FII. Net FII Long Short ratio at 2.8 so FII used fall to exit long and enter short in Index Futures.

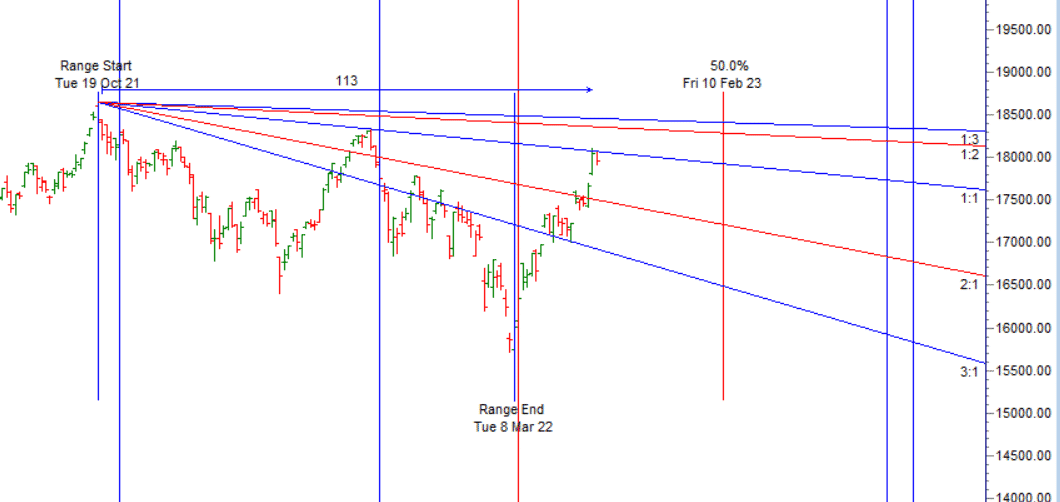

As Discussed in Last Analysis Now Bulls need to move above 18125 for a move towards 18191/18258/18324. Bears will have chance below 18058 for a move towards 17991/17924/17858. 2 Bearish target done below 18058 till we are holding 17791-17828 range bulls have upper hand and its buy on dips market. For Swing Traders Bulls need to move above 17991 for a move towards 18058/18124/18191/18258. Bears will have chance below 17912 for a move towards 17845/17778/17710.

Intraday time for reversal can be at 9:46/10:34/11:27/12:49/1:33/2:21 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17900 PCR at 0.91 , Rollover cost @17418 closed above it. PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty April Future Open Interest Volume is at 1.09 Cores with liquidation of 2.6 Lakh with increase in cost of carry suggesting LONG positions were closed today.

The Option Table data indicates decent support at 17900 and reasonable resistance at 18300 . There is total OI of 4.66 Cores on the Call side and 6.85 Cores on the Put side, So, the activity is more on the PUT side, indicating option writers are in BULLISH zone.

FII’s bought 375 cores and DII’s bought 105 cores in cash segment.INR closed at 75.48.

Today was Mars and Saturn Aspect ,High of 18095 and 17921 is valid for whole year Mark in on your charts and take trade on break of High and Low.

Retailers have bought 649 K CE contracts and 549 K CE contracts were shorted by them on Put Side Retailers sold 204 K PE contracts and 72 K shorted PE contracts were covered by them suggesting having BULLISH outlook,On Flip Side FII bought 60.9 K CE contracts and 62.8 K CE were shorted by them, On Put side FII’s bought 44.9 K PE and 6.8 K shorted PE were covered by them suggesting they have a turned to NEUTRAL Bias.

One of the best parts about trading is that as long as you stay alive (protect your capital) you can always make another trade. Hope all of you had safe trading

For Positional Traders Stay long till we are holding Trend Change Level 17811 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 18076 will act as a Intraday Trend Change Level.

I mark one month candle then One Weak candle then after day candle, As Sir, advice I found magic trade level in hour

Thanks

Swing nifty range idintitfy scale ?