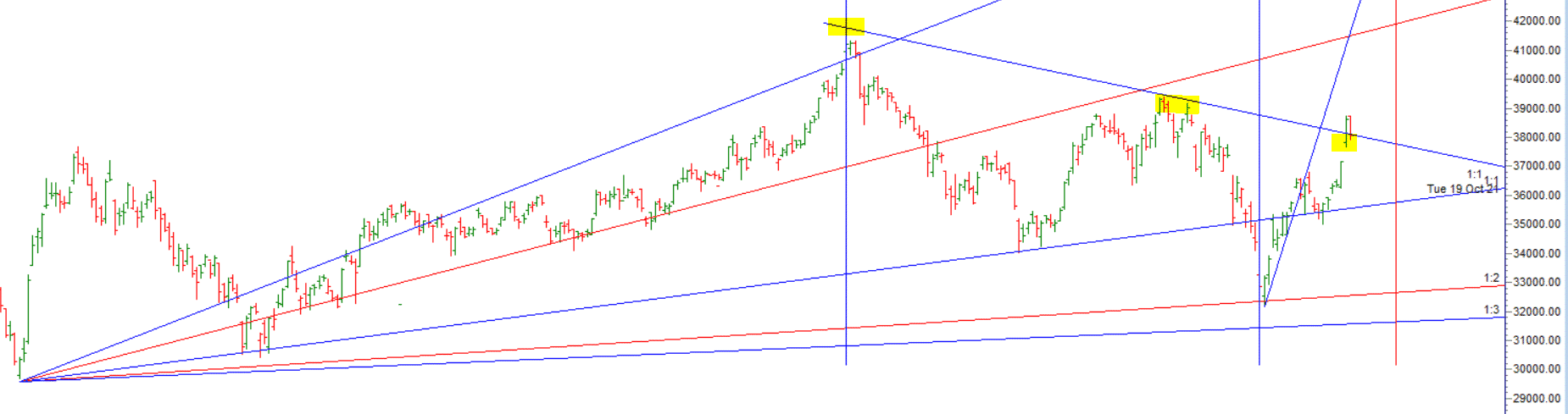

As Discussed in Last Analysis Now Bulls need to move above 38830 for a move towards 39024/39218 Bears will have chance below 38441 for a move towards 38247/38053/37859. 2 Bearish target done below 38441 till we are holding 37666-37700 range bulls have upper hand and its buy on dips market. For Swing Traders Bulls need to move above 38168 for a move towards 38365/38562/38759. Bears will have chance below 37971 for a move towards 37774/37578/37381.

Intraday time for reversal can be at 9:46/10:34/11:27/12:49/1:33/2:21 How to Find and Trade Intraday Reversal Times

Bank Nifty March Future Open Interest Volume is at 21.1 lakh with liquidation of 1.2 Lakh contract , with increase in Cost of Carry suggesting SHORT positions were closed today.

The Option Table data indicates decent support at 37500 and reasonable resistance at 39000 . There is total OI of 3.40 Cores on the Call side and 4.57 Cores on the Put side, So, the activity is more on the PUT side, indicating option writers are in BULLISH zone.

MAX Pain is at 38000 and PCR @1 Rollover cost @36128 closed above it and Rollover % @58.8 lowest in last 3 month.

Today was Mars and Saturn Aspect ,High of 38759 and 37935 is valid for whole year Mark in on your charts and take trade on break of High and Low.

One of the best parts about trading is that as long as you stay alive (protect your capital) you can always make another trade. Hope all of you had safe trading

For Positional Traders Trend Change Level is 37273 on Futures and go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 38346 will act as a Intraday Trend Change Level.