TCS announced the record date for its mammoth buyback offer. Here’s an opportunity to make huge, short term returns.

Tata Consultancy Services Limited (TCS) is engaged in providing information technology (IT) services, digital and business solutions. The Company’s segments include banking, finance and insurance services (BFSI); manufacturing; retail and consumer packaged goods (CPG); telecom, media and entertainment, and others, such as energy, resources and utilities, hi-tech, life science and healthcare, s-Governance, travel, transportation and hospitality, and other products. Its services portfolio consists of IT and assurance services, business intelligence and performance management, business process services, cloud services, connected marketing solutions, consulting, engineering and industrial services, enterprise solutions, IT infrastructure services, mobility products and services and platform solutions. Its software offerings include Digital Software and Solutions, TCS BaNCS and TCS MasterCraft, among others. It serves industries, including insurance, healthcare, retail, telecom and others

During a buyback, a company repurchases its shares from existing shareholders, usually at a price higher than the prevailing market rate. As a result, the number of shares outstanding in the market reduces.

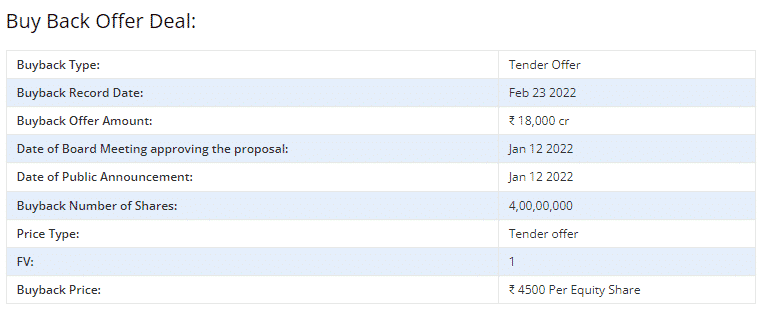

Details of Buyback:

TCS Buyback -How Retail Investors can make money

The quota for retail investors is always reserved at 15% of the total buyback.

Hence, of the 40 m shares being bought back by TCS, 6 m shares will be earmarked for retail investors. At the current market price of ₹ 3,735, the premium is the highest at 20% with the buyback price fixed at ₹ 4,500.

Entitlement ratio gives an indication of the minimum number of shares that will definitely be accepted in the buyback. It’s always calculated on the record date.

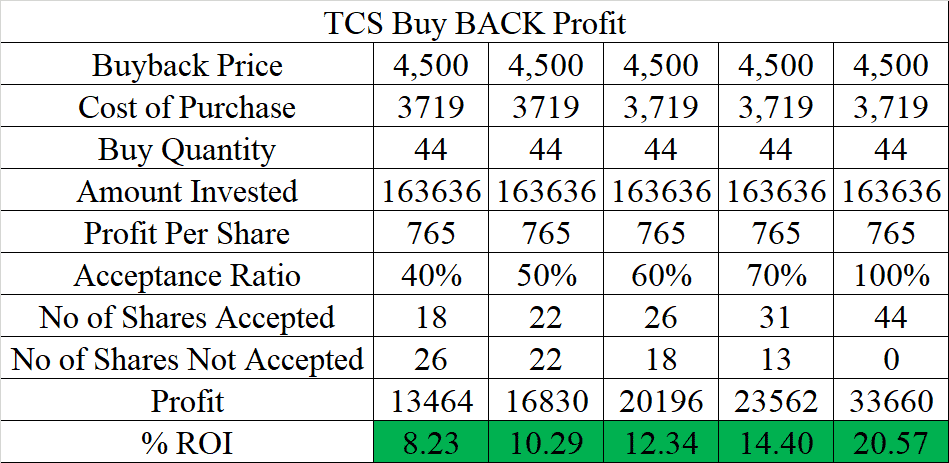

We look at 5 possible scenarios below using simple calculations to arrive at potential possibilities using a strategy to make money in the short term with minimal risk.

The buyback process is usually completed within 2-3 months.

Even if a retail investor doesn’t tender his shares, he could potentially gain from the rise in share price on strong fundamentals of a company that has been consistently rewarding its shareholders.

This could be a good opportunity for short term investors willing to take a well calculated risk to make a good return on their investment.

Too Late for your article.