FII bought 20.4 K contract of Index Future worth 1748 cores, Net OI has increased by 12.1 K contract 16.2 K Long contract were added by FII and 4.1 K Shorts were added by FII. Net FII Long Short ratio at 1.15 so FII used fall to enter long and exit short in Index Futures.

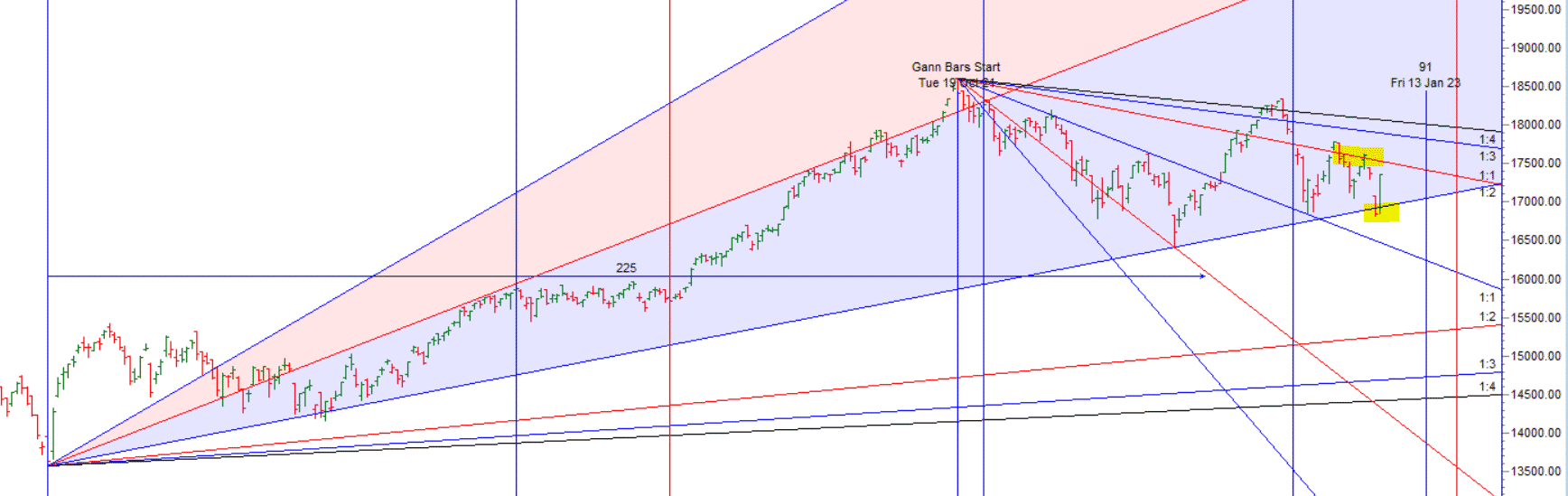

As disussed in Last Analysis We got the big fall today and we are back to 200 DMA Support as discussed in below video We have 2 Important Bayers Date and 2 Aspect with North Node suggesting again we will see voaltile move. We have also closed below Jan low of 16836.

Bayer Rule 6: The price is in bottom when Mars was in 16 degrees 35 minutes of some sign and plus 30 degrees.

Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes.

Swing Shorts below 16838 can see fall towards 16772/16707/16640. Long above 16967 can see rally back to 17034/17099. Bayers date showed there impact we saw a big rally in market. This is how Astrology and Gann ANalysis keep you 1 step ahead. Swing Shorts below 17270 can see fall towards 1718/17107. Long above 17400 can see rally back to 17470/17525.

Intraday time for reversal can be at 10:02/11:03/12:15/1:45/2:27 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17200 PCR at 0.97, Rollover cost @17295 closed above it.

Nifty Feb Future Open Interest Volume is at 0.94 Cores with addition of 0.01 Lakh with increase in cost of carry suggesting LONG positions were added today.

There is total OI of 8.52 Cores on the Call side and6.96 Cores on the Put side, So, the activity is more on the CALL side, indicating option writers are in BEARISH zone.

It was a complete reversal,A remarkable rally born out of complete bearishness and which changed the complete complexion of the game. We are not out of woods so be ready for volatile move and trade with right position size.

Retailers have sold 513 K CE contracts and 250 K shorted CE contracts were covered by them on Put Side Retailers bought 639 K PE contracts and 526 K PE contracts were shorted by them suggesting having BEARISH outlook,On Flip Side FII bought 98 K CE contracts and 17.4 K CE were shorted by them, On Put side FII’s bought 40.3 K PE and 33.5 K PE were shorted by them suggesting they are still having to BEARISH Bias

FII’s sold 2298 cores and DII’s bought 4411 cores in cash segment.INR closed at 75.40

For Positional Traders Stay long till we are holding Trend Change Level 17366 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17104 will act as a Intraday Trend Change Level.

Great analysis