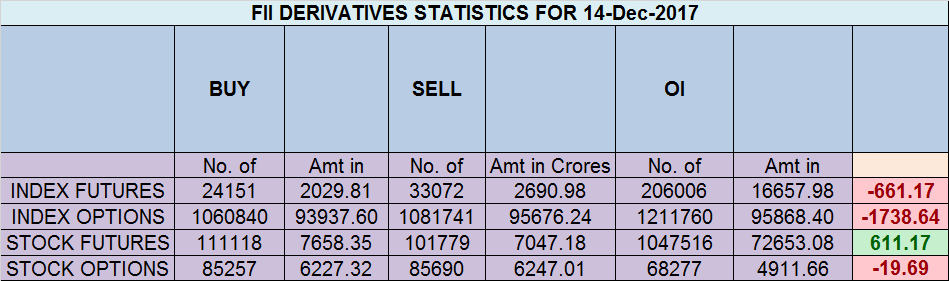

- FII’s sold 8.9 K contract of Index Future worth 661 cores ,11 K Long contract were covered by FII’s and 2.1 K Short contracts were covered by FII’s. Net Open Interest decreased by 13.2 K contract, so fall in market was used by FII’s to exit long and exit short in Index futures. FII’s Long to Short Ratio at 1.14. Election Results Exit Poll Summary for Gujarat and Himachal Pradesh

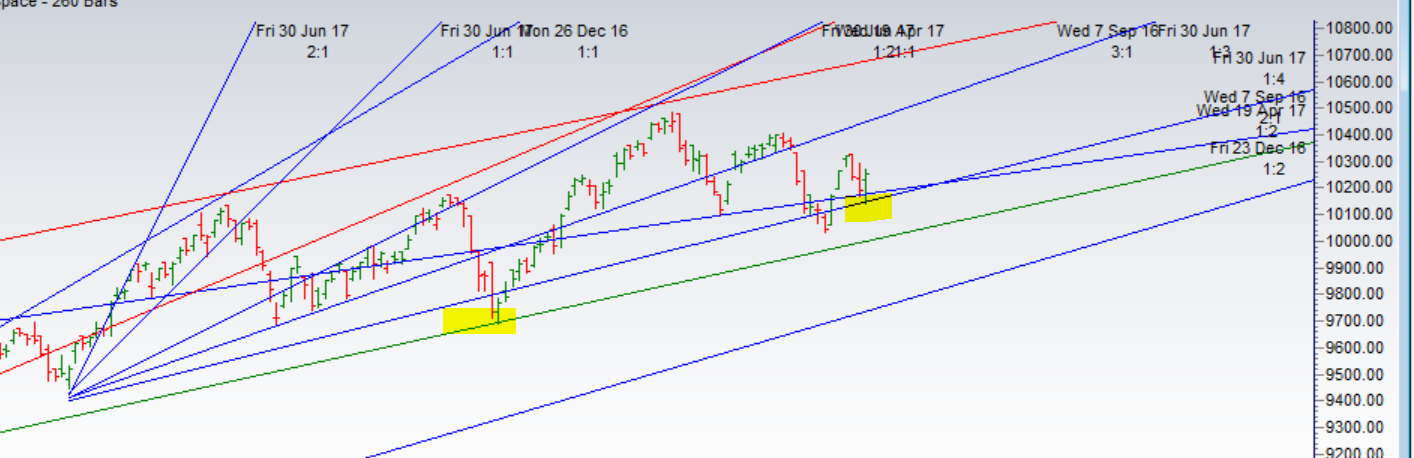

- As discussed in last analysis Now tommrow is again time cycle date so low and high will be important also we can see trend change. Bullish above 10250 for a move towards 10320/10410. Bearish below 10150 for a move towards 10090/ 10000. Price has again come around the gann angle so we should get 150-200 points move in nifty also we have the event overhang of election results. Nifty made low of 10142 and close above above 10250 showing a good recovery on time cycle turn date.as today was trend change date so today’s high and low are very important suggesting we are heading higher towards 10326/10410 till 10250 is held. Bearish below 10140 for a move towards 10090/10000/9930. Today low was exactly at gann angle support,If today low is held we did price time squaring today and should be heading towards 10410/10490. Bank Nifty Analysis before Gujarat Election last phase voting

- Nifty Dec Future Open Interest Volume is at 2.14 core with addition of 0.83 Lakh with increase in cost of carry suggesting Long position were added today, NF Rollover cost @10396 closed below it.

- Total Future & Option trading volume at 12.47 Lakh core with total contract traded at 1.49 lakh , PCR @0.85

- 10500 CE is having Highest OI at 69.5 Lakh, resistance at 10400 followed by 10500 .10100-10600 CE added 14.8 Lakh in OI so bears added major position in range of 10300-10400 . FII sold 2.6 K CE and 2.9 K CE were shorted by them. Retail sold 126 K CE and 86 K shorted CE were covered by them.

- 10000 PE OI@96 lakhs having the highest OI strong support at 10100 followed by 10000. 10000-10600 PE added 11.2 Lakh in OI so bulls added position in 10100-10200 PE. FII sold 7.4 K PE and 14.3 K shorted PE were covered by them. Retail sold 11.7 K PE and 41.6 K shorted PE were covered by them.

- FII’s bought 232 cores and DII’s sold 374 cores in cash segment.INR closed at 64.34

- Nifty Futures Trend Deciding level is 10221 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10221. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10300 Tgt 10330,10360 and 10410 (Nifty Spot Levels)

Sell below 10250 Tgt 10223,10200 and 10150 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh