Jet Airways

Positional/Swing Traders can use the below mentioned levels

Close above 521 Tgt 555/576

Intraday Traders can use the below mentioned levels

Buy above 512 Tgt 521,530 and 539 SL 505

Sell below 500 Tgt 495,485 and 470 SL 505

ICICI Bank

Positional/Swing Traders can use the below mentioned levels

Close above 186 Tgt 199

Intraday Traders can use the below mentioned levels

Buy above 185 Tgt 187.5,191 and 194 SL 183

Sell below 181.5 Tgt 180,177 and 173 SL 183

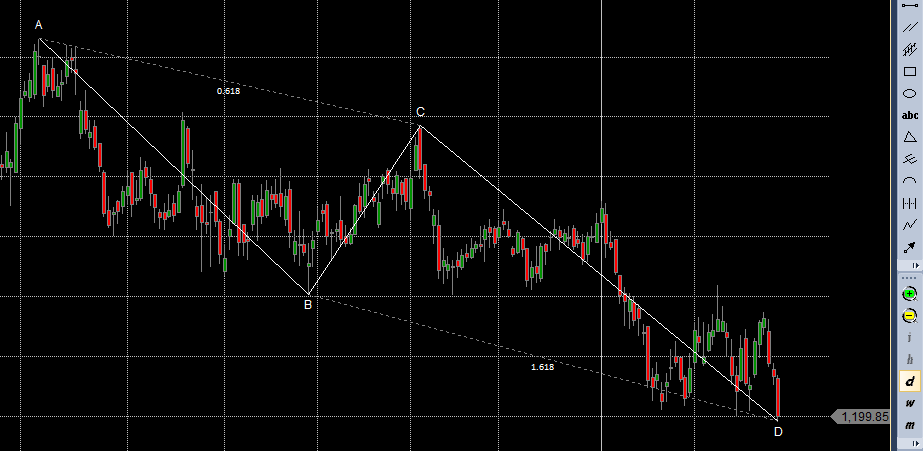

ACC

Positional/Swing Traders can use the below mentioned levels

Close above 1220 Tgt 1280/1364

Intraday Traders can use the below mentioned levels

Buy above 1211 Tgt 1224,1240 and 1250 SL 1200

Sell below 1195 Tgt 1186,1172 and 1150 SL 1205

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for January Month, Intraday Profit of 3.57 Lakh and Positional Profit of 4.36 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

thanks Bramesh for the ideas..but missed the call on ACC..

Dear sir,

Would like to know more about your ta course. Whether it is online and what is the fees structure. Can you please mail me the details to godivyago@gmail.com.thanks