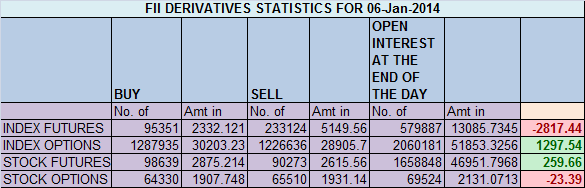

- FII’s sold 137 K contract of Index Future worth 2817 cores, 117 K Long contract were squared off by FII’s and 20.4 K short contracts were added by FII’s. Net Open Interest decreased by 96 K contract ,so FII’s squared off big quantity long in Index futures in.

- Nifty saw the biggest decline of current bull market, Biggest falls in Indian stock market history saw a one side decline through out the session and is approaching support zone of 8035-8080 where we need to observe the price action. Again I would reiterate on declines like today buy quality stocks for good appreciation. Bullish Sentiments have taken a big hit today and this will form the base for next leg of rally.

- Nifty Future Jan Open Interest Volume is at 1.91 core with liquidation of 15.4 lakh in OI. Big liquidation seen by both FII’s and retailers in todays fall.

- Total Future & Option trading volume was at 2.91 lakh core with total contract traded at 8 lakh. Huge volumes were seen today.

- 8400 CE OI at 47.9 lakh so wall of resistance @ 8400.8200/8300 CE saw addition of 33.3 lakhs so bears are back with a bang and strong resistance at 8300. FII bought 34.2 K CE and 56.4 K CE were shorted by them.

- 8100 PE OI@ 44.3 lakhs so strong base @ 8100. 8200/8300 PE liquidated 18.8 lakh so bulls have to lost the ground completely. FII bought 91.5 K PE and 8 K PE PE were shorted by them.

- FII’s sold 1570 cores in Equity and DII bought 1189 cores in cash segment.INR closed at 63.58

- Nifty Futures Trend Deciding level is 8237 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8330 and BNF Trend Deciding Level 18736 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18871, Traders following TC levels were rewarded handsomely .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8158 Tgt 8188,8218 and 8244 (Nifty Spot Levels)

Sell below 8100 Tgt 8080,8050 and 8030 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

brameshji,i trade nifty and bank nifty option position, may i know which chart i consider the best tool this mean hourly,daily,weekly or all

Saravananji,

It depends on system you follow.

Rgds,

Bramesh

I am newbie , i am trying to understand Nifty 7000 Put feb series , why it didnot rise even when market fell more than 3 % , howevver i see it’s risen today more than 200 % . i fail to understand the reason

Can you please explain the secret behind this and how to tame such type of trades for quick profits .?

There is no recipe for quick profits. Learn Earn and put in lots of hardwork.

Rgds,

Bramesh

sirji……as 16 jan 2015 is important day ..so pls give guidelines……….as it will turning point… or bottom formation as per the past dates

Will be updated when time is appropriate.

Rgds,

Bramesh

The Fall is so stunning, and with Gap. Early warning sign for bullishness. Great Fall being forwarned

Dear Sir

Thank you so much for the Gann date, Chopad level for the week which gave great rewards…

7961 nifty spot

Sir, Nifty at 100DMA, 61.8% (golden ratio), at two occassions Nifty reversed from this level, yet there is a rising wedge pattern in daily chart bottom of which comes at around 8000 NF.

Thanks for sharing your views.

Rgds,

Bramesh

Si can you give levels for nifty according to fibonnacci fan 38.2 & 23.6