- FII’s sold 20.3 K contract of Index Future worth 827 cores, 12.3 K Long contract were squared off and 8 K short contracts were added by FII’s. Net Open Interest decreased by 4.3 K contract , so FII squared off long and added shorts in Index futures.

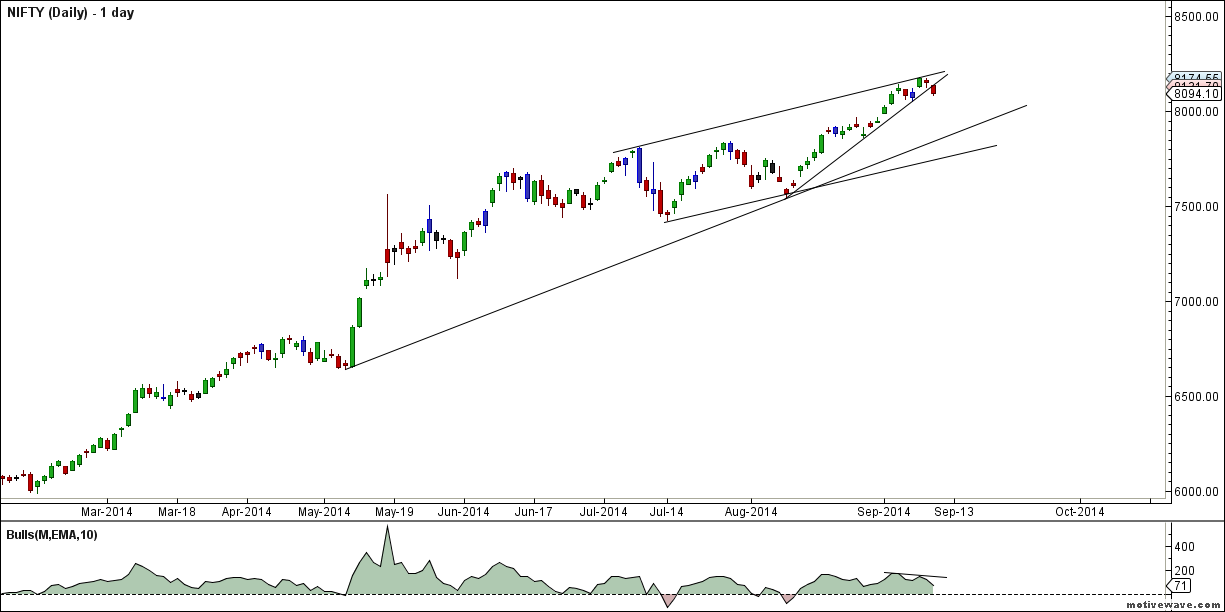

- Nifty opened with downward gap, continued trading in small range and ended almost days low. Nifty broke its Hourly channel as shown below and also rising trendline in daily chart, 8050-8060 needs to be watched closely in coming 2 session. On Upsise move above 8135 can see Nifty moving back to 8160-8170 odd levels.

- Nifty Future Sep Open Interest Volume is at 1.44 cores with liquidation of 6.9 lakh suggesting long liquidation.VIX being very low suggests bulls are still overconfident and every dip is getting bought into.

- Total Future & Option trading volume was at 1.86 lakh core with total contract traded at 1.1lakh. PCR @0.97.

- 8300 CE OI at 58.2 lakh suggesting wall of resistance , 8200 CE added 2.8 lakh .8100 CE added 3.2 lakh suggesting bears are planning to attack 8100 in next 2 session . FII’s bought 2.2 K CE longs and 12.2 K CE were shorted by them.

- 8000 PE OI@ 83.2 lakhs so strong base @ 8000. 7900 PE OI@58.2 so support building up @7900, 7800 PE added 1.9 lakh in OI. FII’s bought 39.3 K contract PE longs and just 7.4 K PE were shorted by them.

- FII’s sold 9 cores in Equity and DII sold 511 cores in cash segment.INR closed at 60.9.

- Nifty Futures Trend Deciding level is 8132 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8109 and BNF Trend Changer Level (Positional Traders) 16100.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8104 Tgt 8125,8152 and 8180 (Nifty Spot Levels)

Sell below 8082 Tgt 8072, 8050 and 8018 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

20 points

Hi Bramesh,

What is the SL for Nifty upside trade? Thanks.

Anand