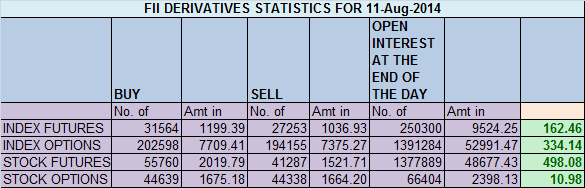

- FII’s bought 4311 contract of Index Future worth 162 cores, 3.2 K Long contract were added and 1 K short contracts were squared off by FII’s. Net Open Interest increased by 2.1 K contract , so after big selling on Friday FII again started buying Index Futures but in small qunatity.

- Nifty after Friday decline, open with Gap up today partly filled the gap and closed above 50 SMA @7617. Tomorrow Important level to watch is 7679-7685 range.Nifty is forming an expanding triangle on daily chart, to complete the same a low near 7490-7500 is required. We have IIP and CPI data release tomorrow after market hours so trde cautiously. As per time analysis big intraday move is round the corner in next 2 days.

- Nifty Future Aug Open Interest Volume is at 1.25 cores with addition of 3.2 lakh suggesting long addition with increase in CoC. VIX being very low suggests bulls are still overconfident and every dip is getting bought into.

- Total Future & Option trading volume was at 1.23 lakh core with total contract traded at 1.4 lakh. PCR @0.79.

- 8000 CE OI at 65.8 lakh suggesting wall of resistance , 7800 CE saw addition of 3.6 lakh suggesting bears are getting stronger @ 7800.7700/7600 CE saw minor liquidation and if after tommrow gap up no further liquidation suggests market will start it pullback again. FII’s bought 20.4 K CE longs and 7.9 K CE were shorted by them. Huge short in CE needs to be taken by caution.

- 7500 PE OI@ 57.3 lakhs saw addition of 2.3 lakh suggest bulls are getting breath of life , 7600 PE added 8.2 lakh addition in OI, and 7700 PE also aded 1.5 lakh OI , suggesting bulls are making a comeback but strength of bulls will be tested in next 2 days.FII’s sold 4 K contract PE longs and just 62 shorted PE were covered by them.

- FIIs sold 163 cores in Equity and DII bought 235 cores in cash segment.INR closed at 61.18.

- Nifty Futures Trend Deciding level is 7633 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7688 and BNF Trend Changer Level (Positional Traders) 15177 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7640 Tgt 7660,7680 and 7710 (Nifty Spot Levels)

Sell below 7620 Tgt 7604, 7584 and 7568 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Hi,

I have a question.

As per FII derivative statistic that you post everyday with analysis since 1st of Aug or beginning of this series, FIIs are net buyers of nifty options and have bought more than 6500 crores of options till date. On the other hand, they are net sellers of nifty futures and have sold 2900 crores of index futures. Does this indicate anything as FIIs are expected to sell options.

Can you please cover the relevance in today’s post?

Thanks & Regards,

Abhi

FANTASTIC ANALYSIS

what does HUGE SHORT In CE mean…why this warrants caution