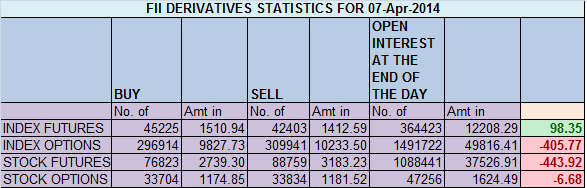

- FII’s bought 2822 contract of Index Futures worth 98 cores (5.2 K longs were added and 2.4 K shorts were added Index Future) with net OI increasing by 7700 contracts.

- Nifty has broken the up trending channel and resisted on Monday’s session.Nifty continued to form lower low formation. Nifty formed DOJI candle suggesting confusion is market participants. 6765 is very important number to be watched any weekly close above it can see Index rallying to 6909, unable to do so pullback can come till 6621 in short term.

- Nifty Future April Open Interest Volume is at 1.67 cores with addition of 1.2 lakhs in Open Interest, OI is giving neutral bias.

- Total Future & Option trading volume at 1.28 lakh with total contract traded at 2. lakh , PCR (Put to Call Ratio) at 1.09.

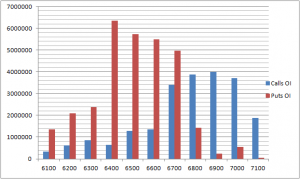

- 6900 Nifty CE is having highest OI at 39 lakhs , resistance for the market, 6800 CE with OI at 31.4 Lakhs, so any rise near 6800 can be a good shorting opportunity tomorrow. Call Options are not having high OI suggesting bears are on back foot. FII’s sold 8.2 K CE longs and 9.9 K CE shorts were taken by them.6300-7000 CE liquidated 11.2 lakhs.

- 6400 PE is having highest OI at 62.1 lakh with addition of 6.9 lakhs remains a strong support for the series, 6700 PEOI at 48.6 lakh neess to be watched closely coz if NF premium comes down 6700 PE huge unwinding can be seen,6300-7000 PE added 14.7 lakhs.FII’s bought 3.6 K PE longs and 1.4 K PE shorts were covered taken by them.

- FIIs bought 703 cores in Equity and DII sold 1081 cores in cash segment.INR closed above 60.1

- Nifty Futures Trend Deciding level is 6727 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6736 and BNF Trend Changer Level (Positional Traders) 12715 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6730 Tgt 6764,6805 and 6825 (Nifty Spot Levels)

Sell below 6688 Tgt 6655 6615 and 6580 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

sir, chart nexus software EOD is free or not.If it is free how to down load.pl.explain