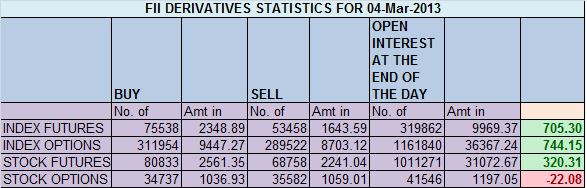

- FIIs bought 22080 contracts of Index Future worth 705 cores (24915 Long contracts were added and 2835 short contract were added ) with net Open Interest increasing by 27750 contracts, so FII’s added huge longs in index future and marginal shorts were added.

- Nifty after yesterday rise is near its trendline resistance, 6300-6320 range has seen many pullback, so traders longs as per PAC should book profit in this range.

- Nifty Future March Open Interest Volume is at 1.45 cores with addition of 10.8 lakhs in Open Interest,so addition of longs.

- Total Future & Option trading volume at 1.22 lakh with total contract traded at 2.4 lakh , PCR (Put to Call Ratio) at 1.10.

- 6300 Nifty CE is having highest OI at 51.2 lakhs , remain resistance for the series. 6200 CE saw liquidated today of 2.6 lakhs suggests weak bears panicked and liquidated,6000-6500 CE added 6.5 Lakh in OI.FII’s bought 23.8 K contract of CE and 2.3 K CE were shorted .

- 6200 PE is having highest OI at 64 lakh with addition of 8.1 lakhs suggesting bulls wants to hold 6200, 6300 PE added 8.9 lakhs,having OI at 33.5 lakhs bulls are not in hurry to close above 6300, 6000-6500 PE added 27.7 Lakh in OI .FII’s added 17 K contract of PE and 16 K PE were shorted.

- FIIs bought 185 cores in Equity and DII sold 344 cores in cash segment.INR closed at 61.84

- Nifty Futures Trend Deciding level is 6303 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6276 and BNF Trend Changer Level (Positional Traders) 10781.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Positional longs got triggered both in NF and BNF

Buy above 6303 Tgt 6328 ,6358 and 6375(Nifty Spot Levels)

Sell below 6272 Tgt 6242,6230 and 6215 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

addition

Sir,

One doubt regarding your intraday levels… i am tracking the nifty movements according to your levels from a week.. they are really accurate.. but i wanted to understand how to use effectively..

For example.. today nifty opened above 6303 …. so no chance of entering fresh long… what do you suggest do in that case? wait for 5972 break or buy around 6303 with SL or SAR as 5972.

Hope you understood my concern.. what is best way to use these intra levels… in different scenarios.. like gap up abv buy area… gap down below sell area.. etc.. on flat days… ur levels offering trades with clarity.. on gap up/down… it is confusing for me..

hope for detail reply.

thanks in advanse

Dear Ravii,

Thumb Rule Trade when level comes, No Level = NO trade. Gap up we have different strategy to trade which is covered in my trading course.

RGds,

Bramesh