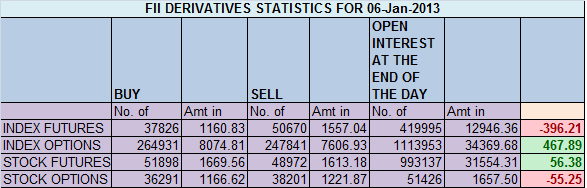

- FIIs sold 12844 contracts of Index Future worth 396 cores (4106 Longs were added and 16950 shorts were added ) with net Open Interest increasing by 21056 contracts, so FII’s added majority shorts and partial long as hedge in today’s session.

- Nifty closed below its 50 SMA and Bank Nifty below its 200 DMA, which is bearish for market in short term. Bullish only above 6225, on downside strong support at 6136-6141 and after that 6091.

- Nifty Future January Open Interest Volume is at 1.77 cores with addition of 1.5 lakhs in Open Interest,with reduction in cost of carry signalling long liquidation and short addition.

- Total Future & Option trading volume at 0.89 lakh with total contract traded at 1.7 lakh .PCR (Put to Call Ratio) at 0.96.

- 6300 Nifty CE is having highest OI at 48.5 lakhs , remain resistance. 6400 CE added 1.5 lakh and 6200 CE added .9 lakhs signalling call writers are increasing position in 6200 CE, hence we could see break the 6200 in coming days. 6000-6500 CE added 10.7 Lakh in OI.FII’s sold 4.1 K contracts of CE.

- 6200 PE is having highest OI at 42.5 lakhs suggesting strong support at 6200, 6100 PE added 39.5 lakh as 6200 PE looks vulnerable, 6100 PE added 2.9 lakh sand will be next support of the market. 12 Lakh PE added in 5700-5900 strike price signalling we can see a steep decline in coming session, 6200-6400 PE added 5.2 Lakh in OI. FII’s for 2 day in row added in PE, total 80K contracts have been added in 2 days mostly in 5700 and 5800 PE.

- FIIs sold 319 cores in Equity ,and DII sold 22 cores in cash segment.INR closed at 62.31.

- Nifty Futures Trend Deciding level is 6223 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6318 and BNF Trend Changer Level (Positional Traders) 11418.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6195 Tgt 6221,6250 and 6272 (Nifty Spot Levels)

Sell below 6166 Tgt 6141 ,6120 and 6091 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/