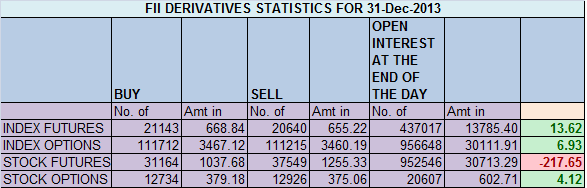

- FIIs bought 503 contracts of Index Future worth 13 cores (5227 Longs were added and 4724 shorts were added ) with net Open Interest increasing by 9951 contracts, so FII’s added both shorts and long in today’s session.

- Nifty gave highest Yearly and Monthly close and formed an inside candle which indicates sharp movement is due in the index either side. Also as per time analysis we can see a sharp move of 2 Jan +-1 day.Nifty moved in narrow range about 30 points.The breakdown / breakout levels are placed at 6260 / 6345 respectively.

- Nifty Future January Open Interest Volume is at 1.97 cores with addition of 4.9 lakhs in Open Interest,with increase in cost of carry signalling short liquidation and long addition.Low volume days are like this only.

- Total Future & Option trading volume at 0.52 lakh with total contract traded at 0.99 lakh lowest in 2013 .PCR (Put to Call Ratio) at 0.95.

- 6500 Nifty CE is having highest OI at 43.9 lakhs , still remain resistance. 6400 CE added 0.4 lakh and no major liquidation in 6300 signalling call writers holding the base strong at 6300. 6000-6500 CE added 0.3 Lakh in OI.FII’s bought 3K contracts of CE.

- 6200 PE is having highest OI at 35.5 lakhs suggesting strong support at 6200 and will be short term bottom of the market. 6300 PE added 3.5 lakh suggesting fight on from 6300. 6200-6400 PE added 4.6 Lakh in OI.

- FIIs bought 310 cores in Equity ,and DII sold 278 cores in cash segment.INR closed at 61.79.FII invested 20 Billion$ in 2013

- Nifty Futures Trend Deciding level is 6354 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6352 and BNF Trend Changer Level (Positional Traders) 11511.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6303 Tgt 6332,6352 and 6374 (Nifty Spot Levels)

Sell below 6280 Tgt 6262 ,6250and 6232 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/