Site was having some problem last evening so FII data analysis post got removed. The problem has been resolved 🙂

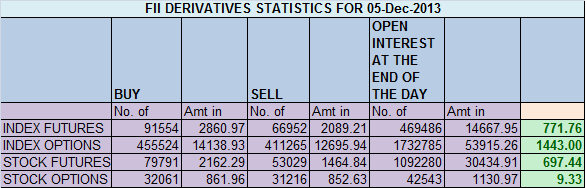

- FIIs bought 24602 contracts of Index Future worth 772 cores (27306 Longs were added and 2704 shorts were added ) with net Open Interest increasing by 30010 contracts, so FII’s added both long and short in Index futures majority longs suggesting volatile move ahead in next 2 days.

- Nifty reacted positively to Exit Poll results and made a gap up till 6300, and broke its range from 6220-5970 on upside, Tommrow we have weekly closing Bulls will try to close nifty above 6232 and bear below 6153. As suggested in morning NF unable to move above 6341 will come down to 6237 as per Chopad levels.

- Nifty Future December Open Interest Volume is at 1.90 cores with addition of 9 lakhs in Open Interest,with increase in cost of carry signalling long addition

- Total Future & Option trading volume at 1.18 lakh with total contract traded at 2.7 lakh.PCR (Put to Call Ratio) at 0.94.VIX corrected from channel top and Option premium also crashed significantly.

- 6500 Nifty CE is having highest OI at 57.8 lakhs ,6400 CE added 13.1 lakhs Will remain initial top of market. FII’s bought 55.1 K in Call mostly 6400 and 6500 CE and 9.4 K CE were shorted mostly 6100 and 6200.5800-6500 CE added 9.3 Lakh in OI

- 6000 PE is having highest OI at 48.6 lakhs suggesting strong support at 6000.6100 and 6200 and 6300 PE added 6 lakh in OI suggesting buying happening and traders are hedging there longs. 6100 is emerging support for market.FII’s bought 525 contract in PE mostly 5900 and 5800 PE and 1.9 K PE were shorted.5800-6500 PE liquidated 13.3 Lakh in OI.

- FIIs bought 1152 cores in Equity ,and DII sold 674 cores in cash segment.INR closed at 61.76.

- Nifty Futures Trend Deciding level is 6304 For Intraday Traders). NF Trend Changer Level (Positional Traders) 6232 and BNF Trend Changer Level (Positional Traders) 11319 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6258 Tgt 6280 ,6300 and 6307 (Nifty Spot Levels)

Sell below 6232 Tgt 6215 ,6190 and 6160 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/