- November 2013 is one of the best series till date as Nifty has closed above 6092 after making a new life high of 6342. December series has two crucial events one is State election results which will be declared on 9 Dec and 18 Dec RBI policy. From Historical Data only 3 Years ie 2000,2001 and 2011 has given negative returns highest being 4.3% in December month rest 10 years have been positive 0.4-4% so except positive closing on December series.

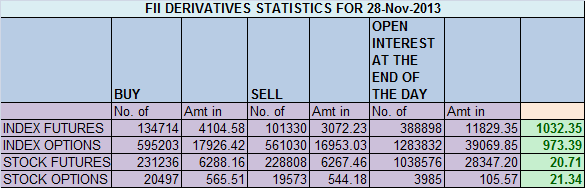

- FIIs bought 33384 contracts of Index Future worth 1032 cores with net Open Interest decreasing by 171132 contracts, so FII were in square of mode today.Nothing major to read in data.

- Bullish move only on close above 6140 and Bearish below 5972 in between its just playing in range. Tomorrow we are having monthly closing Bulls will try to close nifty around 6180 odd levels and bear below 6000 so we can see a good move tomorrow.

- Nifty Future December Open Interest Volume is at 1.7 cores with addition of 32 lakhs in Open Interest,1.16 lakhs got rollovered in Dec series in past 5 trading sessions.Rollover range comes at 6176-6036 so keep a close eye on these levels.

- Total Future & Option trading volume at 2.86 lakh with total contract traded at 2.7 lakh.PCR (Put to Call Ratio) at 0.88.

- 6300 Nifty CE is having highest OI at 40 lakhs ,Will remain initial top of market. 6500 CE saw addition of 9 lakh suggesting speculative buying at start of series.5900-6500 CE added 17.7 Lakh in OI

- 6000 PE is having highest OI at 45.9 lakhs suggesting strong support at 6000.6100 PE added 7.1 lakh in OI test of 6100 PE writers will be seen tommrow.5900-6500 PE added 24.1 Lakh in OI

- FIIs bought 103 cores in Equity ,and DII bought 330 cores in cash segment.INR closed at 62.4.

- Nifty Futures Trend Deciding level is 6152 For Intraday Traders). NF Trend Changer Level (Positional Traders) 6152 and BNF Trend Changer Level (Positional Traders) 11059 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6100 Tgt 6120,6140 and 6160 (Nifty Spot Levels)

Sell below 6068 Tgt 6035 ,5995 and 5972 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/