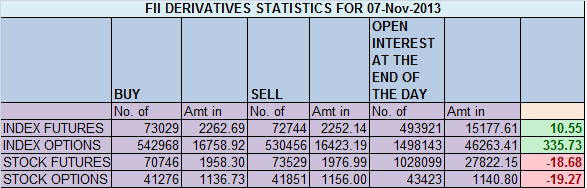

- FIIs sold 285 contracts of Index Future (sold 6964 long contract and 7249 shorts were covered ) worth 10 cores with net Open Interest decreasing by 16247 contracts.So today fall on back of S&P news was used by FII’s to exit shorts.

- Nifty continued with its correction for 3 day running and broke the crucial support of 6200 and closed below it,Nifty is near the 61.8% of the current rise from 6079 (Low made on RBI Policy day ) and High of 6332 made on Muhrat trading day,so 6180-6164 is strong support zone. Holding the same Nifty can bounce back till 6300, On Downside break of 6164 Nifty can correct all the way up to 6080.

- Nifty Future November Open Interest Volume is at 2.08cores with liquidation of 7.4 lakhs in Open Interest,cost of carry has fallen so shorts are entering the system and long liquiation.

- Total Future & Option trading volume at 1.40 lakh with total contract traded at 3.5 lakh.PCR (Put to Call Ratio) at 0.91, more calls are getting traded.

- 6300 Nifty CE is having highest OI at 44.5 lakhs with addition of 6.4 lakhs in OI,Will remain initial top of market. 6400 CE added 1 lakh in OI, 10 K CE were added by FII and 25.6 K CE were shorted.6100-6500 CE added 12 Lakh in OI

- 6000 PE added 1.9 lakh and having highest OI suggesting strong support at 6000, 6200 PE liquidated 0.56 lakh in OI,suggesting 6200 PE writers panicked today.26.3 K PE longs were added by FII’s and 5 K shorted PE were covered. 6100-6500 PE added just 150 contract in OI.So FII’s 1.15 Lakh PE is last 4 trading sessions.

- FIIs bought 479 cores in Equity ,and DII sold 715 cores in cash segment.INR closed at 62.41

- Nifty Futures Trend Deciding level is 6275 For Intraday Traders). NF Trend Changer Level (Positional Traders) 6314 and BNF Trend Changer Level (Positional Traders) 11541.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6219 Tgt 6257,6289 and 6317(Nifty Spot Levels)

Sell below 6205 Tgt 6181,6150 and 6125 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Dear Sir,

i follow your lessons and highly appreciate your great efforts to educate us seamlessly. thanks a lot.

but i have certain weaknesses:

a) i stick to a loosing trade ‘hoping’ it will turn in my favour,

b) i know when to enter a trade, yet i donot enter actually, i donot know why?

your suggestions will be greatly admired. or should i stay away from trading for sometime?

regards

Parimal.

Dear Parimalji,

You lack trading psychology, You need to work on it !!

Rgds,

Bramesh