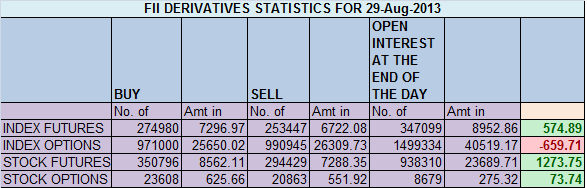

- FIIs bought 21533 contracts of Index Future (Booked profit in 284902 shorts and 102716 longs were squared off ) worth 575 cores with net Open Interest decreasing by 387618 contracts. Today’s rise was backed by short covering and fresh positions will be take tomorrow.It has been an awesome series with profit of 1.89 lakh as per Intraday Stock performance@http://tradingsystemperformance.blogspot.in/

- Nifty has taken support at last fibo fan support as discussed yesterday and today showed the expected pullback.Now its heading towards an important resistance zone of 5426 the breakdown levels and 5477 previous support. The Nifty had formed a bullish ‘Morning Star’ pattern on the daily charts and which needs confirmation. Nifty has rallied 310 points from low of 5118 formed yesterday, some profit booking can be expected from the range of 5426-5477 tomorrow.We have monthly closing tomorrow,Bulls will try to close nifty above 5479 and bear below 5368. Lets see who emerge as a Winner.

- Nifty Future Sep Open Interest Volume is at 1.46 cores with addition of 14.9 lakhs in Open Interest, so starting the new series on lighter note. Rollovers range comes at 5120-5484.

- Total Future & Option trading volume at 3.2 lakh with total contract traded at 4.8 lakh ,PCR (Put to Call Ratio) at 1.17. VIX closed below 30.

- 5400 Nifty CE is having highest OI at 24.9 lakhs with addition of 1.9 lakhs in OI. 5300 CE added 5.6 lakh in OI will be support in short term. 5200-5600 CE added 17.9 lakh in OI.

- 5300 PE OI at 5.1 lakh remain the highest OI, remains the firm support for time being. 5200 PE added 7.6 lakh in OI, huge put writing happening from start of series. 5400 PE also added 7.7 lakh in OI.5200-5600 PE added 19.7 lakh in OI. So Intital Range as per Option data comes from 5300-5500.

- FIIs sold in Equity in tune of 248 cores ,and DII sold 75 cores in cash segment, nothing major in cash segment suggesting today we saw a technical bounce and follow up is required tomorrow ,INR closed at 66.6 Rupee,positing biggest gain in 15 years after RBI intervened, Ideas to Save Rupee downfall

- Nifty Futures Trend Deciding level is 5426 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 5384 and BNF Trend Changer Level (Positional Traders) 8917.

Buy above 5429Tgt 5458,5478and 5500(Nifty Spot Levels)

Sell below 5400 Tgt 5380,5350 and 5332 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Will 20 pts be a stoploss for a trend changer level too?

yes