- FIIs sold 3473 contracts of Index Future (Book profits in 47 Contracts of shorts and 3520 longs ) worth 101 cores with net Open Interest decreasing by 3567 contracts. So as per data analysis, FII’s have started booking profit in Long in NF and BNF entered on last 2 days. Trading Funda : Think Less & Keep It Simple

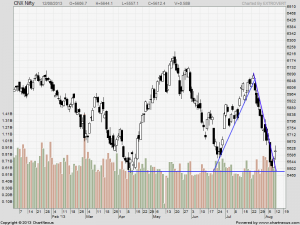

- June IIP at -2.2% versus -1.6% in May which again shows contraction happening in Industrial production. Nifty opened gap up today, at 5606 than quickly came down to fill the gap, Nifty made low of 5557 which was Chopad level as disucced in Weekly analysis and gave the much anticipated rally. Nifty has formed a DOJI candlestick formation and if we fall tommrow we can form a Evening star candlestick formation which will be bearish in short term. Bank Nifty made high Weekly Trend Deciding level of 9846 and came down to hit forst target. Below 9846 Bank Nifty will be ruled by bears.

- Nifty Future Aug Open Interest Volume is at 1.46 cores with liquidation of 12 lakhs in Open Interest with cost of carry moving in negative , long booking profit and shorts entering into system.

- Total Future & Option trading volume at 1.20 lakh with total contract traded at 2.64 lakh , PCR (Put to Call Ratio) at 0.91.VIX is sustaining above breakout area and in turn ATR range of nifty is increasing which is good for intraday traders :),Quadrant System made a profit of 253 Points in past week.

- 6000 Nifty CE is having highest OI at 64 lakhs with liquidation of 1.16 lakhs in OI. 5800 CE added 1 lakh in OI and having second highest OI at 57 lakh. As per Option data OI analysis FII entered long in 4.5K call options and booked profit in call shorts ie call writing in 5.2 K OTM Calls so any upside will be limited. 5400-6000 CE added 3.3 lakh in OI.

- 5400 PE OI at 71lakh remain the highest OI, with addition of 3.4 lakh in OI, remains the firm support. 5500 PE added 8.6 lakh in OI is emerging support for Nifty,As per Options Data analysis, FII has booked profit in 2.2K Longs and added 1.4 K in Put writing , so still holding there PE so cautious on upside. 5400-6000 PE added 17.4 lakh in OI.

- FIIs bought in Equity in tune of 408 cores ,and DII bought 259 cores in cash segment ,INR closed at 61.27.

- Nifty Futures Trend Deciding level is 5575 (For Intraday Traders).Nifty Trend Changer Level 5751 and Bank Nifty Trend Changer level 10165.

Buy above 5628 Tgt 5645,5664 and 5692(Nifty Spot Levels)

Sell below 5604 Tgt 5584,5565 and 5550(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

The Index of Industrial Production (IIP) contracted to 2.2 percent in July versus a negative 2.8 percent in June. The June IIP data has been revised higher to minus -2.8 percent from minus -1.6 percent (provisional).