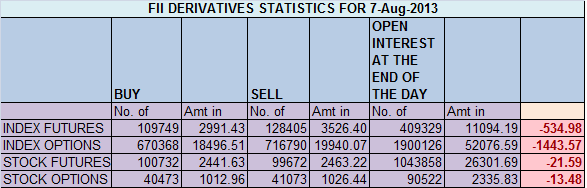

- FIIs sold 18656 contracts of Index Future (Book profits in 7998 Contracts of shorts and 26654 longs were sold) worth 535 cores with net Open Interest decreasing by 34652 contracts. So as per data analysis, FII are still exiting longs and booking profit shorts in NF and Bank NF.FII’s were doing more of intraday trading as average price comes at 8496 🙂 ,Reason for wild swings in nifty today.Tips from Worlds most Successful Trader

- Nifty continued to fall 11 day in a row,in process losing 607 points. Nifty took exact support at the demand area as discussed yesterday,and showed up a small bounceback from 5487-5477 as seen in below chart. Closing was still in red, Any close below 5477 will take nifty to 5426 odd level which is very important support as per Nifty Chopad levels.Tommrow is last trading day of the week as Friday is an holiday,Bulls will press hard to close nifty around 5589 odd levels.

- Nifty Future Aug Open Interest Volume is at 1.55 cores with liquidation of 11 lakhs in Open Interest, shorts booking profit.

- Total Future & Option trading volume at 1.45 lakh with total contract traded at 3.6 lakh , PCR (Put to Call Ratio) at 0.87.VIX is sustaining above breakout area and in turn ATR range of nifty is increasing which is good for intraday traders :).

- 6000 Nifty CE is having highest OI at 67 lakhs with addition of 3.2 lakhs in OI, is wall of resistance and some selective buying. 5800 CE added 10 lakh in OI and having second highest OI at 57 lakh, As per Option data OI analysis FII exited 21K call options and added shorts ie call writing in OTM Calls. 5600-6200 CE added 24 lakh in OI.

- 5400 PE OI at 71 lakh remain the highest OI, with addition of 15.3 lakh in OI, remains the firm support 5600 PE liquidated 9.1 lakh in OI,As per Options Data analysis, FII added 5K contract on long side and booked profit in 6.8K PE which were written. 5600-6200 PE added 2.6 lakh in OI.

- FIIs sold in Equity in tune of 351 cores ,and DII sold 262 cores in cash segment ,INR closed at 61.29,USD INR Weekly Technical Analysis

- Nifty Futures Trend Deciding level is 5555 (For Intraday Traders).Nifty Trend Changer Level 5782 and Bank Nifty Trend Changer level 10230.

Buy above 5522 Tgt 5555,5575 and 5598(Nifty Spot Levels)

Sell below 5500 Tgt 5485,5450 and 5430(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Hi,

Very nice analysis..Thank you for posting it.

Regards.

Dear sir,

i have been reading ur blog regularly, but recently i have found it a bit confusing.

” booked profit in 7998 contracts of shorts & 26654 longs were sold”

sir, where do we get these breakup figures .i.e 7998 & 26654 from ??

Thanks in advance for ur valuable feedback.

Regards,

Vineet Nigum

IDBI

Dear Sir,

This is again as part of trading system we have developed.

Rgds,

Bramesh