- FIIs bought 11527 Index Future worth 339 cores with net Open Interest increasing by 13691 contracts.FII again initiated longs in Nifty and Bank Nifty futures.All you want to know about LIX 15 Index launched by NSE

- Nifty opened with gap up continued with its rally, got resistance at supply zone of 5867,What we are witnessing now is range development, sideways move by market after big downside and swift rally.This is the move in market which most market participants hate as it takes both short and long side stop loss. But we need to expect harsh reality and hold on to our nerves. Try to reduce your trading quantity, book profits as and when they come and as i always say stick to the system. Am repeating the above sentence again and again so that readers do not get stuck up with positions when market catches a trend. So the range bound move continues as discussed before and shown in below chart. We have formed an NR 7 day and expect some impulsive move in coming 2 days.

- Nifty Future July Open Interest Volume is at 1.53 cores with addition of 5.3 lakhs in Open Interest, so long addition seen today.

- Total Future & Option trading volume at 0.89 lakh with total contract traded at 1.78 lakh , PCR (Put to Call Ratio) at 1, VIX after taking support at its rising trendline has bounced back and is again about to give breakout.

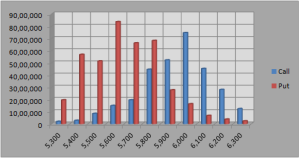

- 6000 Nifty CE is having highest OI at 74 lakhs with addition of 6 lakhs in OI, 6000 remains the ceiling for time being. 5900 CE added 0.56 lakh in OI and 5800 CE liquidated 0.17 lakh, 6 Lakh addition on 6000 CE suggests we can see break above 5920 in next 2 days. 5500-6200 CE added 7.4 lakh in OI.

- 5600 PE OI at 83 lakh remain the highest OI ,5800 PE is having OI of 68.2 lakh addition of 10 lakh suggests 5800 will remain the wall of support for coming week 5500-6200 CE added 13.8 in OI.

- FIIs bought in Equity in tune of 165 cores ,and DII bought 37 cores in cash segment ,INR closed at 61.05 Can rupee touch 65 to a dollar ?

- Nifty Futures Trend Deciding level is 5854 (For Intraday Traders).Nifty Trend Changer Level 5818 and Bank Nifty Trend Changer level 11461.

Buy above 5867 Tgt 5881,5900 and 5920(Nifty Spot Levels)

Sell below 5834 Tgt 5811,5800 and 5785(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863