- FIIs bought 8097 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 246 cores with net Open Interest increasing by 24963 contracts, so again long addition by FII. Want to be Successful Trader ?

- As discussed yesterday Nifty is set to make a decisive move and market oblized us. Losses which were made on Tuesday got wiped off in 1 day and huge profits were also made. This is what I have been telling to readers and teaching my students. “Trust on System”. Nifty opened at 6018 and as per our 9:16, SAR, FII analysis it was a buy in morning and rewards were showered. Nifty has closed above the Weekly trend deciding level at 6120 and made a 28 week high suggesting mometum is strong. Many traders asked Shall i short the market ? My answer Please do not, never go against the trend,If you have long trade profit booking is advised.

- Nifty Future May Open Interest Volume is at 2.50 cores with addition of 25 lakh in Open Interest with increase in Cost of Carry of Nifty Future to showing traders are initiating fresh long position .

- Total Future & Option trading volume at 1.89 lakh with total contract traded at 3.19 lakh , PCR (Put to Call Ratio) at 0.90.VIX has moved to a high of 18.13,Now basic assumption of rise in vix leads to fall in nifty but this is not right. I will discuss the same with a detailed post in weekend.

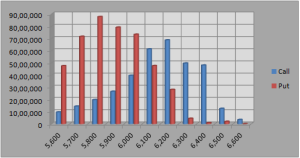

- 6200 Nifty CE is having highest OI at 68 lakhs with liquidation of 4.1 lakhs in OI and remains the wall of resistance ,6100 remains the support level and OI at 68 lakhs .5700-6300 CE liquidated 28.9 Lakhs in OI.

- 5800 Put Option is having highest Open Interest of 87.7 lakhs ,5900 PE added 1.8 lakhs and net OI at 79.2 lakhs,suggesting put writers are again back in action, 6000-63200 PE added 56 lakhs, suggesting 6000 is base now and bulls will try to move base higher at 6100 .5700-6300 CE added 46.3 Lakhs in OI,blowout punch

- FIIs bought in Equity in tune of 1647 cores,and DII sold 747 cores in cash segment ,INR closed at 54.75 Live INR Chart for market hours and currency traders

- Nifty Futures Trend Deciding level is 6188 (For Intraday Traders).Nifty Trend Changer Level 6006 and Bank Nifty Trend Changer level 12570.

Buy above 6160 Tgt 6195,6220 and 6245(Nifty Spot Levels)

Sell below 6130 Tgt 6110,6080 and 6059(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863