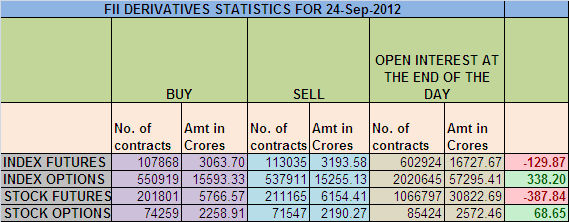

1. FII sold 5167 Contracts of Index Future,worth 129.87 cores with net OI increasing by Huge 74249 contracts.

2. As Nifty Future was down by 25 points and Open Interest in Index Futures increased by 30452, FII have started booking profits on Index Future longs in Nifty and Bank Nifty Futures.

3. NS closed at 5670 after making a high of 5710 and unable to break 5720,Bulls are in control of market and traders are getting overconfidence on taking longs which should be treated as caution whenever overoptimism comes in market time to be cautious .Stock markets moves in direction which give maximum pain to traders to short term traders.So trade with strict stoploss as we are approaching expiry. After big rise on Friday we had a session of consolidation today.

4. Resistance for Nifty has come up to 5700 and 5720which needs to be watched closely ,Support now exists at 5648 and 5618 .Trend is Buy on Dips till 5547 is not broken on closing basis.

5. Nifty Future September Open Interest is at 2.15 cores with a unwinding of 6.8 Lakh in OI,profit booking in longs is seen in Nifty future .Rollovers have started in NIfty Futures with addition of 21 lakhs in October series.Fresh longs are created in October series.

6. Total F&O turnover was 1.71 lakh Cores with total contract traded at 2.22 lakh. PCR at 0.95 and VIX at 18.83.

7. 5800 CE is having highest Open Interest of 76 lakhs with fresh addition of 15 lakhs in OI.5700 CE Open Interest at 70 lakhs, with addition of 3 lakhs.Immediate support is at 5648 as 5600 CE sheded 3 lakhs as per Open Interest table. 5300-5900 CE added 12 lakhs in Open Interest.

8. 5600 PE added 3 lakh in Open Interest total OI at 78 Lakhs,Bulls want to make 5600 as base for September Series. 5300-5900 PE added 5.7 lakhs in Open Interest so option activity shows Bulls in wait and watch mode.

9.FII bought 1585 cores and DII sold 1156 cores in cash segment,INR closed at 4 months high at 53.48 Live INR rate @ http://inrliverate.blogspot.in/).FII sold 387 cores in Stock Futures.

10. Nifty Futures Trend Deciding level is 5440, Trend Changer at 5680 NF. (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand).

Buy above 5681 Tgt 5700,5720 and 5740

Sell below 5648 Tgt 5634,5618 and 5600 (Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

this has been happening in all previous expiry.. buying current month. shorting next month. thats why such a big increase in OI.

confusing the retail.

YUPP PERFECT !!

Rgds,

Bramesh