Inflation cooled to 7.25% which is welcome news for market as it raises the Hope for RBI to cut rates.From Macro perceptive Monsoon is current overhang for the market, any shortfall in rains can again see the food prices spiraling ahead and putting weight on inflation.

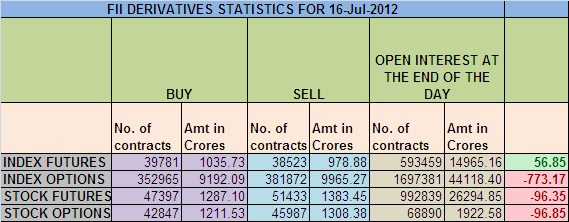

1. FII bought 1258 Contracts of NF ,worth 56.85 cores with net OI increasing by 3550 contracts.

2. As Nifty Future was down by 33 points and OI has increased by 3550 contracts means FII have covered partial shorts near 5204 NF. Also the Average price for NF comes at crazy number 9038 which suggests some longs were also carried over by FII

3. NS made a low of 5190 which is just 1 point short of 5189 which we have been discussing from many days,not breaking 5189 suggests bulls want to push market higher. We also took a risky call to buy near 5194-5200 NS range with a strict sl of 5189 as discussed in Facebook page. NS needs to moves above 5220 for any kind of bullishness to return in market.

4. Resistance for Nifty has come up to 5250 which needs to be watched closely tomorrow,Support now exists at 5150 if 5189 gets taken out.Today we had the range expansion with NF going into 86 points range and which was rewarded by Quadrant system followers. NF have been falling for 4 days in a row

5. Nifty June OI is at 2.39 cores with an fresh addition of 1.98 Lakh in OI, As Nifty was down by 33 points with rise in OI shorts were added.

6. Total F&O turnover was 1.07 lakh Cores with total contract traded at 2.16 lakh, Volumes were low even though Range for NF was 86 points.Cash volumes were lower than on Friday which suggests no delivery based selling even though we closed below 5200.

7. 5300 CE saw an addition of 8.8 lakhs and total OI stands at 85 lakhs and 5400 CE has the highest OI at 92 lakhs. So 5300 is an immediate upper ceiling.Even though NS closed below 5200, 5200 CE added 7 lakhs in OI which suggests Bulls are still confident of saving 5200.

8. On Put side 5000 PE is having highest OI of 84 lakhs with 2 lakhs fresh addition meaning 5000 is current base for market,Liquidation of 13 lakhs was seen in 5000-5300 PE .5100 is the immediate support for market based on Options data.Today FII sold 773 cores worth of Options which suggests FII have shorted PE as Premium was high today, so if 5189 do not gets broken we can see the rise in market.

9.FII bought 257 cores and DII sold 40 cores in cash segment.FII has pumped in 7218 cores in July series in cash segment. INR closed at 55.35 Live INR rate @ http://inrliverate.blogspot.in/)

10. Nifty Futures Trend Deciding level is 5207, Trend Changer at 5297 NF (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand).

Buy above 5212 Tgt 5227,5247 and 5278

Sell below 5189 Tgt 5176,5150 and 5130 (Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

could you pls explain how have you calculated the average price for NF as 9038.It will grateful of you.

Dear Sir,

This is generated as per the FII analysis.

Rgds,

Bramesh

NF down by 33 points and OI increasing meaning FII covering short is not understood. becoz as per my knowledge fall in price with fall in oi means more shorts entering the system. please explain?

Average Rate for NF comes at 9038 which make me say NF longs were entered.

Rgds,

Bramesh