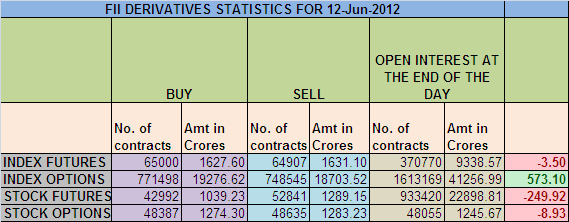

1. FII bought 93 Contracts of NF ,OI increased by 20735.FII have created again longs in Index future.

2. As Nifty Future was up by 74 points and OI has increased by 20735 contracts means FII have created fresh longs in Index futures.

3. Nifty made a high of 5129 and closed above both 200 DMA@5068 and 50 DMA@50874, which is a bullish confirmation. Many market participants were surprised by this rally as we had a worse IIP data,but flip side it increases the probability of rate cut. Till 4938 is not broken Bulls have upper hand

4. Lets zoom into the FII Datasheet we can see their net OI is up by 66K contracts and Nifty is up by 301 points so they are net long for June series and if rate cuts did not come or we get a global shock we can see the unwinding of the longs.

5. Nifty June OI is at 1.57 cores with a fresh addition of 6.4 lakhs in OI,longs were added. Range as per Rollover data comes at 4825-5013, and we have comfortable closed above 5013.Todays low was also 5022.

6. Total F&O turnover was 1.18 lakh Cores with total contract traded at 3.63 lakh.

7. 5000 and 5100 CE of June saw an unwinding of 5.5 lakhs as we broke above 5125 and unwinding started,5200 CE has seen 2.78 Lakhs addition today with total OI now at 58 lakhs. Ceiling has increased to 5200 on Higher end.

8. On Put side 4800 PE is having highest OI of 80 lakhs making 4800 a strong base,4600 PE has added almost 3.8 lakhs in OI almost 10 lakhs OI added in 2 days so smart money is buying lower strike puts, As FII Put buying price comes at 4848 so they are active in lower strike puts which are available at dirt cheap premium.

9.FII sold 56 cores and DII sold 54 cores in cash segment. INR closed at 55.88 Live INR rate @ http://inrliverate.blogspot.in/)

10. Nifty Futures Trend Deciding level is 5027, Trend Changer at 4950 NF (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand).

Buy above 5130 Tgt 5158,5178 and 5202

Sell below 5084 Tgt 5067,5044 and 5015 (Nifty Spot Levels)

Global News Bond Yields of Spain and Italy are at 2012 highs

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

Hi Bramesh,

I follow the level as mentioned in ur site… its awesome… very useful.. thank u so much for doing such a nice job….

Thanks

Anne

Thanks a lot !!

Rgds,

Bramesh

very good. market moving as alalysed by you. thanks please inlude bank nifty too. jay shriman narayan.

Thanks a lot sirji !!

Rgds,

Bramesh