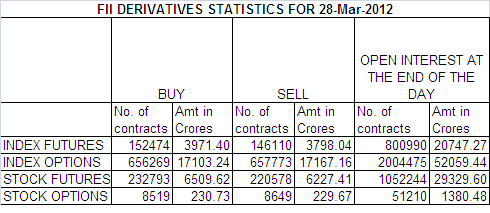

Below is my Interpretation of FII OI data Sheet for 28-Mar-12.

1. FII bought 6364 Contracts of NF worth 174 cores OI also increasing by 52478 contracts.

2. As Nifty Futures was down by 54 points and OI has increased by 70131 contracts means institutions have created fresh shorts in NF as net OI has risen with fall in price.

3. Nifty for the 3 day was unable to move above 50 SMA@5302. Again saving grace comes that Bulls are protecting 200 SMA@5151 Till Nifty is trading above this level bulls still have a chance for Pullback.

4. Nifty has formed double bottom on Daily charts by making low of 5171 today.Double bottom are bullish pattern if low of 5171 is not broken for next 2 days.

5. Nifty March OI has decreased by 13 lakh .Total OI stands at 1.76 cores contracts. Short covering was seen in NF.

6. Roll Over have started with April NF adding 28 lakhs in OI basically meaning shorts are getting rollovered from March to April. April NF OI is 1.65 cores . 28 lakh fresh shorts were added in April Series . Yesterday we told to keep an eye of 5225 on April NF today low was 5221.

7. Almost 1 core NF got rolloverd in range of 5221-5370 range and we are assuming mostly these are shorts so accept a good move on break of 5221 on downside and 5370 on upside.

8.Total F&O turnover was 1.89 Lakh Cores with total contract traded at 398323. Equity volumes have been reducing every time nifty reached the 5171 levels which suggests selling intensity is slowing and case for a bounce back can be made.

9. In equity FII sold 148 cores and DII bought 73 cores. FII sitting on sidelines till more details emerge on GAAR.

10. 5300 CE is having highest OI of 69 Lakhs with fresh addition of 13 lakhs. Expiry will be below 5300 looking at Call Options.

11. 5100 PE having highest OI of 94 lakhs . 5200 PE OI is at 55 lakhs with unwinding of 8 lakhs.

12. FII Average traded price in futures comes at 5448 which basically means they did lot of day trading today also they have carried shorts for tomorrow. Are we breaking the 5171 range will be see closely. We need to save 5159(Feb Low).5151 (200 SMA) tomorrow. Looking at Options set up expiry looks to happen at low of series if 5171 gets broken tomorrow.

13. Nifty Futures Trend Deciding level is 5181, Trend Changer at 5350 NF (Above this Level Bulls will rule Nifty/Below this levels Bears have upperhand).

Upper End of Expiry:5262

Lower End of Expiry:5127 (Nifty Spot Levels)

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl

To Get Real Time update on Nifty during market hours you can LIKE the page.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Thx again for your analysis.

Very Good

Keep it up

Brgds

Ravi

Thanks a lot Sir !!

Rgds,

Bramesh

Dear Brahmeshji, nice analysis & helpful. On every expiry I missed only one thing – i.e. your view on Expiry. I am expecting expiry around 5250-5270.

Dear Sir,

I have mentioned both upper and lower end of expiry.

Thanks a lot Sir !!

Rgds,

Bramesh