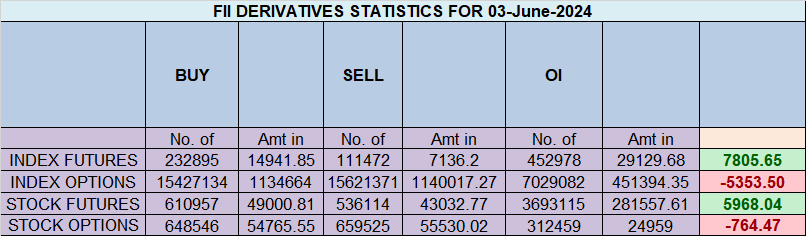

Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by buying 81680 contracts worth ₹4763 crores, resulting in a increase of 36144 contracts in the net open interest. FIIs added 65733 long contracts and covered 55690 short contracts, indicating a preference for adding of long positions and covering short positions. With a net FII long-short ratio of 1.17, FIIs utilized the market rise to enter long positions and exit short positions in Nifty futures. Clients covered 97093 long contracts and covered 55690 short contracts.

NIfty has shown sign of reversal wiith closing below previous day low, TOday is important gann date as discussed in below video so intraday traders can watch for fiorst 15 mins high and low to capture trend for the day.

Today we have Bayer Rule 19: We have tops when Venus in geocentric position passes the conjunction with the Sun. SUN Conju Venus so trade cautiously watch for Imtraday timeing to plan for the trade. Venus have strong impact on stock market so trade with extreme care, VIX will also decline today if no major surprises in Election Results.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 23366 for a move towards 23442/23517/23593 Bears will get active below 23214 for a move towards 23138/23062/22956/22880

Traders may watch out for potential intraday reversals at 09:22,10:25,11:44,1:00,1:46,2:11,02:55 How to Find and Trade Intraday Reversal Times

Nifty June Futures Open Interest Volume stood at 14.3 lakh cr , witnessing a liquidation of 50 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a closure of LONG positions today.

Nifty Advance Decline Ratio at 49:01 and Nifty Rollover Cost is @22514 closed above it.

Nifty Gann Monthly Trade level :23338 close below it.

Nifty closed above its 20 SMA @22514 Trend is Buy on Dips.

Nifty options chain shows that the maximum pain point is at 22200 and the put-call ratio (PCR) is at 1.26. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 23300 strike, followed by 23500 strikes. On the put side, the highest OI is at the 23000 strike, followed by 22800 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 22800-23300 levels.

According To Todays Data, Retailers Have sold 132 K Call Option Contracts And 346 K Call Option Contracts Were Shorted by them. Additionally, They sold 200 K Put Option Contracts And 163 K Put Option Contracts were Shorted by them, Indicating A Bullish Bias.

In Contrast, Foreign Institutional Investors (FIIs) sold 179 K Call Option Contracts And 346 K Call Option Contracts Were Shorted by them. On The Put Side, FIIs sold 355 K Put Option Contracts And 590 K Put Option Contracts were Shorted by them, Suggesting They Have Turned To Neutral Bias.

In the cash segment, Foreign Institutional Investors (FII) bought 6850 crores, while Domestic Institutional Investors (DII) bought 1913 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 22404-23071-23737 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

The only reason to get into a trade is if you see an opportunity and you feel the market has a good chance of moving in your direction. But the reason people usually add on to their losing positions is not because they see another opportunity, but because they don’t want their first opinion to be wrong.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 23321. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 23007, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 23300 Tgt 23343, 23399 and 23444 ( Nifty Spot Levels)

Sell Below 23200 Tgt 23144, 23100 and 23050 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.