Foreign Institutional Investors (FIIs) exhibited a Bullish stance in the Bank Nifty Index Futures market by Buying 9439 contracts with a total value of 666 crores. This activity led to a increase of 8499 contracts in the Net Open Interest.

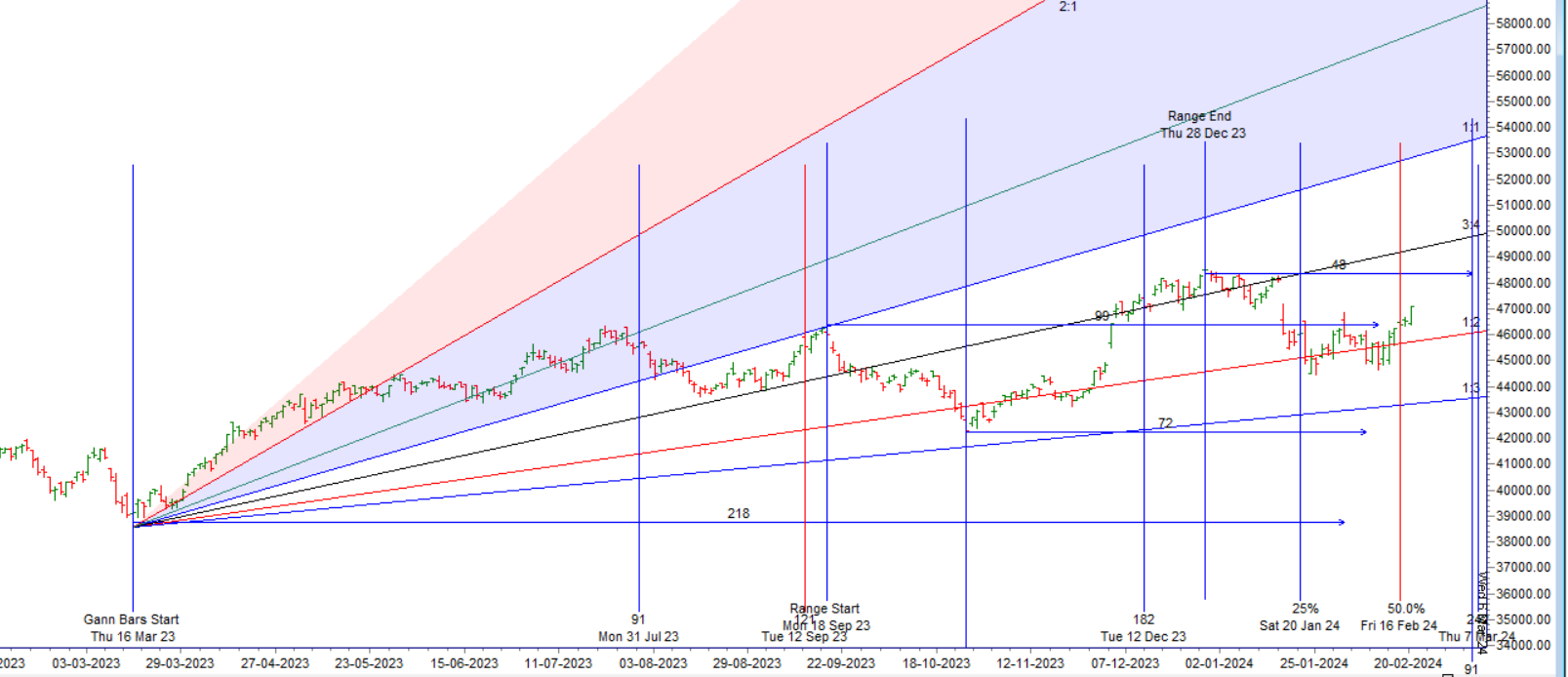

Bank Nifty has formed an NR21 pattern today, range of today was lowest in last 21 trading session, Today was Sun INgress and we formed a perfect doji. Price is near both Sun and Venus INgress levels and 50% Gann Time Cycle suggesting price is ready for an explosive move on levels as mentioned below.

Bank Nifty gave the big move as per combo of astro and gann cycle. Now its time to be cautious on upside as “Bayer Rule 2: Trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes. Leads to Big Move ” has come into effect and we can see downmove in next 2 trading session if the rules holds true, BUlls need to protect 46900 on downside for upmove to continue towards 47500.

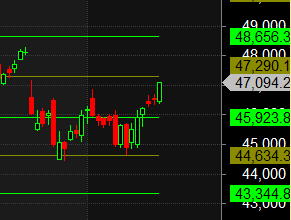

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 47124 for a move towards 47339/47554. Bears will get active below 46909 for a move towards 46694/46479.

Traders may watch out for potential intraday reversals at 10:53,11:26,12:28,1:18,02:22 How to Find and Trade Intraday Reversal Times

Bank Nifty Feb Futures Open Interest Volume stood at 26.9 lakh, with liquidation of 0.07 lakh contracts. Additionally, the decrease in Cost of Carry implies that there was a covering of SHORT positions today.

Bank Nifty Advance Decline Ratio at 08:04 and Bank Nifty Rollover Cost is @45685 closed above it.

Bank Nifty Gann Monthly Buy Trade level : 46450 and Gann Monthly Sell Trade level : 45879

Bank Nifty has closed above its 30 DMA and above 46666 gann level.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43344-44634-45923-47290. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 47265

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 47000 strike, followed by the 47300 strike. On the put side, the 46500 strike has the highest OI, followed by the 46300 strike.This indicates that market participants anticipate Bank Nifty to stay within the 46500-47300 range.

The Bank Nifty options chain shows that the maximum pain point is at 47000 and the put-call ratio (PCR) is at 1.02 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

You’ve told yourself that you need to follow your rules, that you need to trade smaller, or that you should avoid trading during certain market conditions or times of day. Still you make the same mistakes, lose money, and build frustration., your attempts at change fail because they lack emotional force.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 45980. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 46952 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Expiry Range

Upper End of Expiry : 47584

Lower End of Expiry : 46791

BANK Nifty Intraday Trading Levels

Buy Above 47150 Tgt 47300, 47424 and 47584 (BANK Nifty Spot Levels)

Sell Below 46970 Tgt 46866, 46752 and 46610 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.